Ethereum ownership shifts as large holders trim positions and retail participation reaches new highs.

Ethereum Whales Cut Holdings as Retail Share Hits Record, Signaling Market Shift

In Brief

- • Ethereum whale holdings have declined below a key threshold.

- • Retail wallets now control a record share of supply.

- • The shift reflects changing market structure.

Ethereum (ETH)’s supply distribution is shifting, with whales cutting their holdings and retail controlling more.

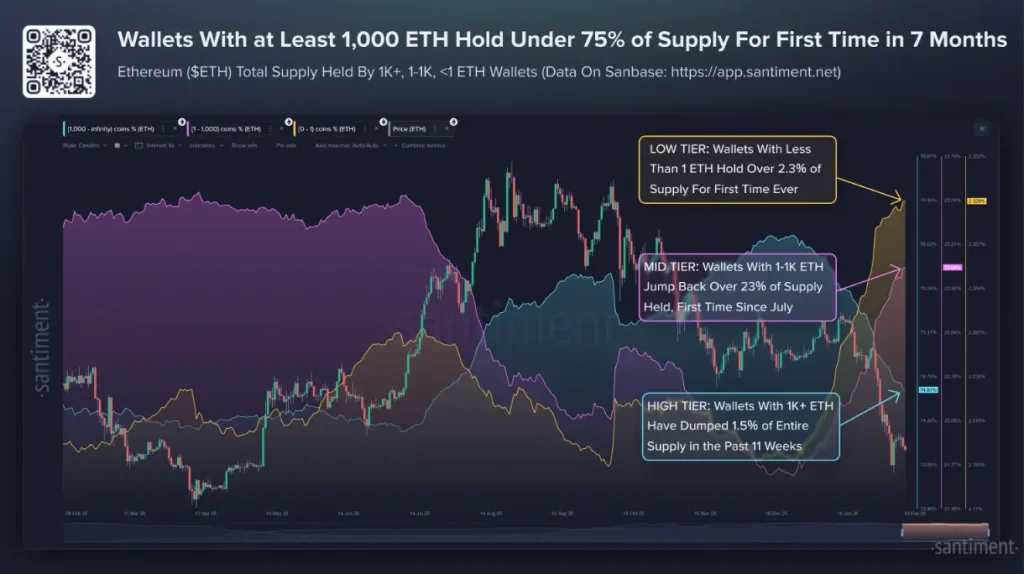

Indeed, according to the recent data shared by blockchain and cryptocurrency market monitoring platform Santiment in an X post on February 11, wallets with at least 1,000 ETH now control less than 75% of Ethereum’s total supply for the first time in seven months.

Since Christmas, these large wallets have collectively reduced their holdings by roughly 1.5% of the total supply.

At the same time, the smallest wallets, those holding less than 1 ETH, now control a record 2.3% of supply.

Whale Holdings Drop Below Key Threshold

Large Ethereum wallets, often categorized as whales, historically hold the majority of circulating ETH. But recent data show a measurable decline in concentration.

Since late December, wallets with 1,000+ ETH have distributed approximately 1.5% of the total supply. That shift pushed their collective share below the 75% mark, a level not seen since mid-2025.

Though 1.5% may sound modest, in Ethereum terms, it represents a significant amount of capital moving across wallet tiers.

This type of redistribution can reflect profit-taking, portfolio rebalancing, institutional activity, or strategic reallocations into staking and decentralized finance (DeFi) products.

Small Wallets Hit Record Share

Meanwhile, the smallest tier of holders is expanding.

Wallets holding less than 1 ETH now account for 2.3% of total supply, the highest percentage ever recorded. Analysts suggest this growth may be partially linked to staking participation and broader retail engagement.

As staking continues to lock ETH into validator contracts and smaller investors accumulate fractional positions, the supply landscape is gradually diversifying.

Mid-sized wallets (1-1,000 ETH) have also seen a relative increase in supply share, indicating redistribution rather than simple capital flight.

At the same time, Ethereum is currently changing hands at the price of $1,958.42, down 2.6% in the last 24 hours, losing 13.1% across the past seven days, and accumulating a decline of 36.9% over the last month, per the most recent information.

Why This Matters

A shift in supply concentration can influence market dynamics. When whale dominance declines and smaller wallets increase their share, it may suggest broader participation and potentially reduced centralization risk.

However, ownership redistribution alone doesn’t guarantee price direction. It simply reflects a changing structure beneath the surface.

For investors watching Ethereum’s next move, this evolving supply balance may offer insight into who is positioning for what comes next.

Ethereum Price Today

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

LINK Futures Go Live on CME Group

2Bitmine Continues Accumulating Ethereum as Holdings Expand

3Ethereum Switched On a New Standard That Changes How AI Uses Crypto

4Federal Reserve Downplays Bitcoin Volatility as Crypto Adoption Grows

5Bitcoin Correction Echoes Past Cycles as Relief Rally Hopes Rise

Latest

Also read

Similar stories you might like.