The White House increases pressure on lawmakers to finalize stablecoin legislation.

White House Urges Stablecoin Deal, Sets the Deadline as Debate Continues

In Brief

- • The White House set a March 1 deadline for a stablecoin deal.

- • Banks want yield bans, while crypto firms seek flexibility.

- • Talks improved, but no agreement was reached.

A second White House meeting between major banks and cryptocurrency industry leaders ended without a formal agreement on stablecoin yield rules, but participants described the discussions as more productive than prior talks.

According to sources cited by journalist Eleanor Terrett in an X post on February 11, both sides engaged in deeper negotiations over whether payment stablecoins should be allowed to offer rewards or yield to holders.

Banks Push Yield Prohibition Principles

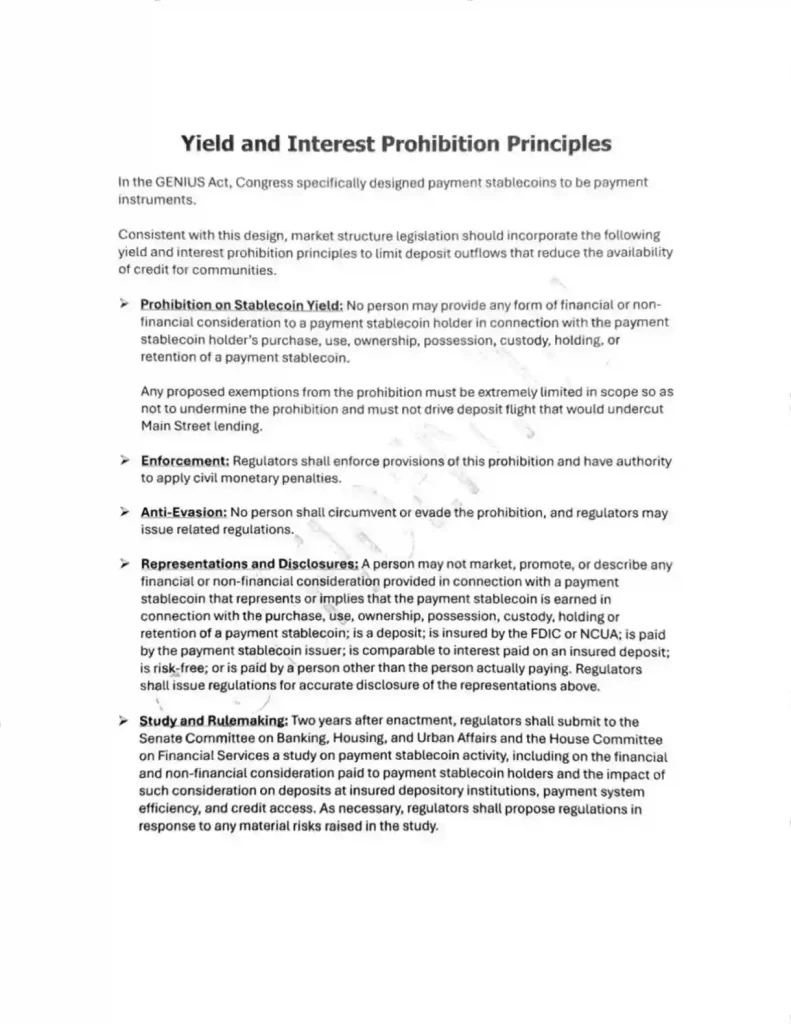

Bank representatives entered the meeting with a written framework outlining ‘prohibition principles’ on stablecoin rewards.

The proposal would ban financial or non-financial rewards tied to holding payment stablecoins, prevent marketing that implies stablecoins function like insured deposits, empower regulators to enforce penalties, and require study and rulemaking within two years of enactment.

A notable shift emerged in the language, allowing “any proposed exemption,” signaling that banks may now be open to limited carve-outs, a position they had previously resisted.

Banks in attendance included Goldman Sachs, JPMorgan, Bank of America, Wells Fargo, Citi, PNC, and U.S. Bank, alongside major trade associations.

Crypto Seeks Broader ‘Permissible Activities’

Crypto firms pushed for clearer and broader definitions of ‘permissible activities,’ which would determine when rewards tied to stablecoin usage could be allowed.

Industry attendees included representatives from Coinbase, Ripple, a16z, Paxos, the Blockchain Association, and the Crypto Council for Innovation.

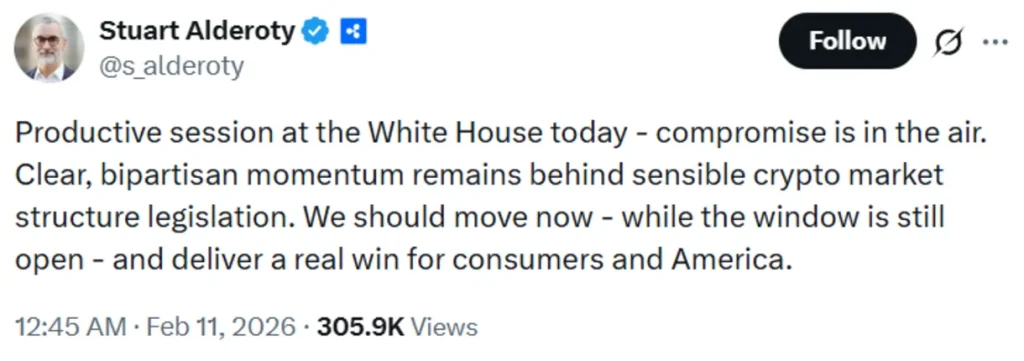

Ripple’s Chief Legal Officer Stuart Alderoty said “compromise is in the air,” suggesting movement toward the middle ground.

Meanwhile, the White House, led by the President’s Crypto Council Executive Director Patrick Witt, reportedly urged both sides to reach an agreement by March 1.

Though there was no final resolution, the smaller meeting format appears to have narrowed disagreements. Further discussions should take place in the coming days, though it remains unclear whether another large-scale session will occur before the deadline.

For stablecoin issuers and users, the outcome could determine whether payment stablecoins remain strictly transactional tools or evolve into interest-bearing financial products.

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

LINK Futures Go Live on CME Group

2Bitmine Continues Accumulating Ethereum as Holdings Expand

3Ethereum Switched On a New Standard That Changes How AI Uses Crypto

4Federal Reserve Downplays Bitcoin Volatility as Crypto Adoption Grows

5Bitcoin Correction Echoes Past Cycles as Relief Rally Hopes Rise

Latest

Also read

Similar stories you might like.