As institutional adoption grows in the U.S a Bitcoin flag stands next to a Tennessee flag.

Tennessee Introduces Bill to Establish Bitcoin Reserve

In Brief

- • Tennessee introduced a bill to create a state-level Bitcoin reserve.

- • The proposal would formally recognize Bitcoin within public finance law.

- • State governments are increasingly exploring Bitcoin as a long-term asset.

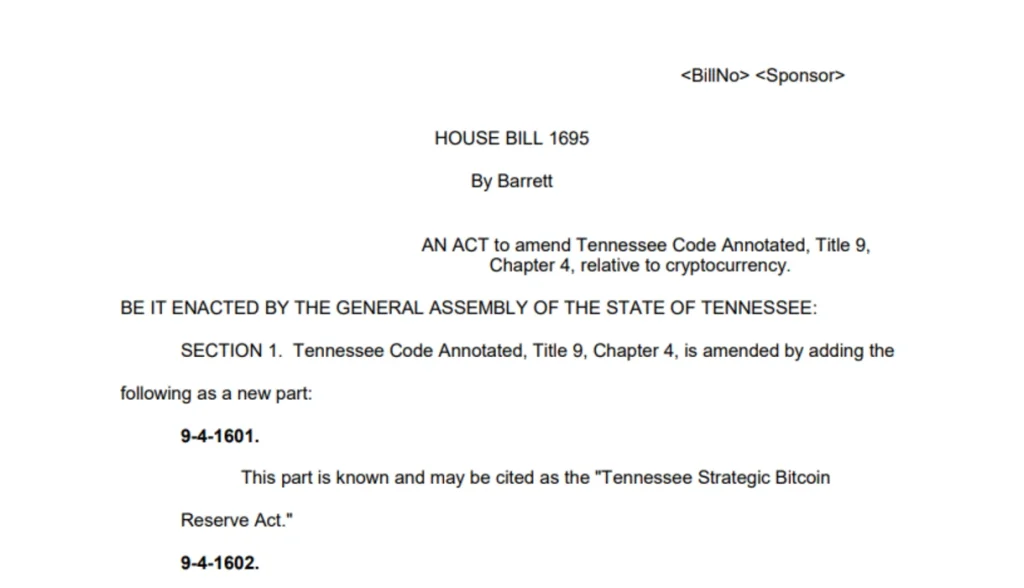

Tennessee State Representative Jody Barrett has introduced House Bill 1695 (HB1695), titled the “Tennessee Strategic Bitcoin Reserve Act”, into the 114th General Assembly.

The bill aims to amend the Tennessee Code Annotated, Title 9, Chapter 4. To provide a legal framework for the state to create a strategic Bitcoin reserve as part of its public financial strategy.

Moreover, the bill’s currently at its early stages and has been submitted to the Government Operations Committee for review.

What The Bill Proposes

According to the text, the legislation would allow Tennessee’s government to establish a framework for strategic Bitcoin management within its financial code.

The legislation’s title and classification indicate that it’s aimed at integrating cryptocurrency into the state’s approach to public funds.

Additionally, The bill signals that it would establish Bitcoin-related policy at the state level. Potentially enabling the state treasurer to adopt Bitcoin holdings or create a reserve strategy under codified guidelines.

Importantly, it must now navigate committee review, possible amendments, and eventually a vote in both chambers of the Tennessee Legislature before it can become law.

If passed, the act would take effect on July 1, 2026, subject to the legislature’s determination that it serves the public welfare.

Bitcoin as a Strategic Reserve Asset

Bills with similar titles and objectives have been introduced in multiple states as policymakers consider diversifying public funds or exploring alternative hedging tools.

Indeed, Proponents of such legislation argue that Bitcoin’s limited supply and global liquidity could serve as a hedge against inflation.

Others emphasize the economic signaling effect of embracing digital assets in public finance. Viewing such initiatives as forward-looking governance in a digital economy.

However, critics warn that allocating public funds to volatile assets carries risks and requires robust governance frameworks to protect taxpayers.

As HB1695 moves through the Tennessee legislative process, both supporters and skeptics will likely weigh in during committee hearings and subsequent deliberations.

Furthermore, crypto enthusiasts will watch closely the progress of this bill. Especially as similar initiatives gain traction in other states’ capitals.

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

Vitalik Warns Crypto’s Biggest Risk Isn’t Hackers – It’s Something Worse

2Peter Schiff Warns of a U.S. Dollar Collapse Far Worse Than 2008

3UAE Central Bank Approves First USD-Backed Stablecoin, USDU

4Russia Finalizes Rules for Bitcoin, Ethereum, and Stablecoins

5Why Bitcoin Looks Weak Today But Strong Long-Term

Latest

Also read

Similar stories you might like.