Mysterious hooded figure representing a hacker sits behind a laptop while a lot of bitcoins float around him symbolizing him extracting them from wallets

KEY TAKEAWAYS

- Modern scams don’t compromise wallets, they compromise context.

- These scams succeed because users act rationally inside setups designed to feel routine.

- The blockchain records what happened, not how you were guided into approving it.

Modern crypto scams increasingly operate by shaping the environment around a user’s decision, guiding them through actions that feel routine while subtly altering outcomes. By the time something feels off, the blockchain already reflects a valid transaction, and the deception that led there leaves no on-chain trace.

Let’s say you signed the transaction yourself, the contract address was correct, and the UI looked exactly like the app you’ve used dozens of times before. Indeed, funds moved where you expected, just not for long.

By the time you realized something was wrong, the transaction history looked normal, support channels were silent, and the protocol’s official account was warning users about “ongoing investigations.”

You weren’t rugged in the classic sense. You were led, step by step, into doing everything “correctly” inside a manipulated environment.

Why This Problem Exists

These failures don’t feel like scams at first. They feel like bad luck, timing issues, or unexplained protocol behavior. Therefore, most users only recognize the pattern after the damage is already irreversible.

Modern crypto scams rarely rely on stealing keys directly. By 2025, the more reliable attack surface is interaction context, not custody. Moreover, the industry is optimized for frictionless UX, composability, and speed.

That optimization created space for manipulation that doesn’t look malicious in isolation.

Three systemic shifts enable this. First, wallet and protocol UX have become highly abstracted. Users no longer read raw calldata or verify every contract interaction because the ecosystem trained them not to.

Second, infrastructure is now deeply layered with front ends, RPCs, indexers, relayers, analytics, and wallets mediating the experience, each with its own trust assumptions.

Third, attackers now operate with the same tooling as legitimate teams, analytics, AI-generated interfaces, bot-driven social engineering, and real-time monitoring.

Instead of forcing users to do something obviously wrong, attackers guide them to do something contextually reasonable inside a distorted frame.

What Most People Get Wrong

Many experienced users still assume scams are discrete events. In reality, modern scams are often process-based. Therefore, the attacker controls timing, narrative, and interface, while the user supplies legitimacy by acting rationally within that setup.

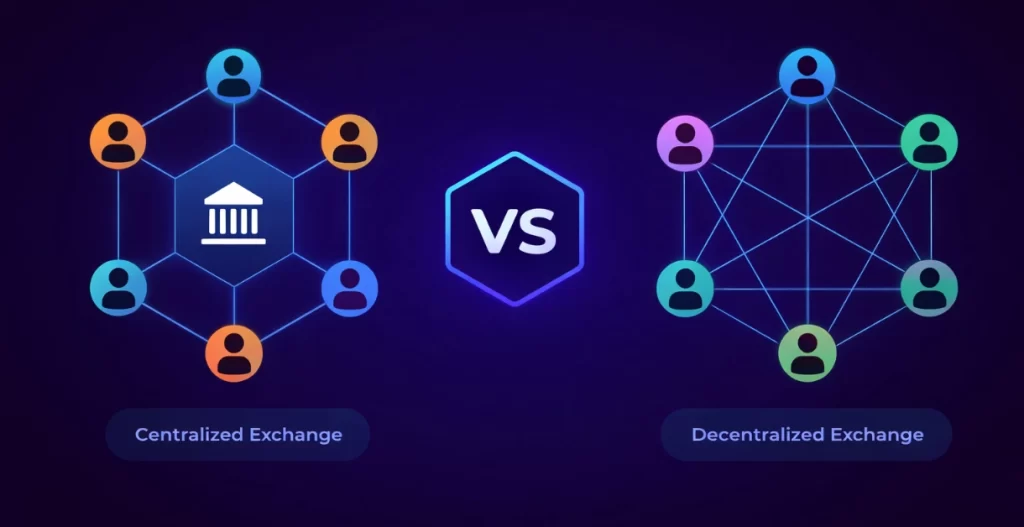

Another common misconception is that decentralization protects against manipulation. However, decentralization increases the number of surfaces where trust is implicitly granted.

When every layer feels optional and interchangeable, users stop verifying any of them deeply, which is exactly what these scams exploit.

How It Actually Works

First, the attacker establishes a credible environment. This might be a cloned front-end served through a slightly altered domain, a malicious RPC that selectively alters responses, or a compromised analytics widget embedded in an otherwise legitimate site.

Moreover, nothing here needs to look broken, it just needs to look familiar.

Then, there comes behavioral steering, with the user manipulated through normal actions like reconnecting a wallet, re-signing a message, retrying a transaction due to “network congestion,” or migrating assets because of an upgrade.

Each step is plausible on its own. The scam isn’t the instruction, it’s the sequence.

Finally, execution happens inside a legitimate-looking flow. What changes is an unseen parameter, destination, or approval scope.

By the time the funds move incorrectly, the user’s mental model is already committed. Meaning they believe they’re finishing a routine task, not authorizing an irreversible loss.

Keep in mind that the blockchain records the result. However, it doesn’t record the deception that led there.

Real-World Scenarios

Scenario 1: The “Stuck Transaction” Loop

A user attempts a swap during high congestion. The UI reports repeated failures and suggests reconnecting the wallet via a different RPC.

Therefore, the alternative endpoint subtly alters gas estimation and calldata previews. On the final attempt, the transaction succeeds, but includes an approval that drains funds minutes later.

Scenario 2: Fake Recovery Flows

After a real protocol exploit, scammers deploy mirror sites advertising “position recovery” or “claim portals.” Moreover, the contracts are real, deployed recently, and heavily funded to appear legitimate.

Users interact because something actually did go wrong, and the scam feeds on the urgency created by a genuine incident.

Scenario 3: DAO Tooling Compromise

A multisig signer uses a popular dashboard to queue transactions. Then, the dashboard UI is compromised, altering display order and recipient labels while preserving on-chain correctness.

Signers approve what they believe is payroll with funds, then routed to an attacker-controlled address that mimics an internal wallet.

Scenario 4: AI-Assisted Social Engineering

An attacker joins a protocol’s Discord, answers support questions accurately, and builds trust over weeks.

Therefore, when a user reports an issue, the attacker provides step-by-step instructions tailored to the user’s on-chain history.

In all of these cases, the user acted reasonably, and that’s why scams work.

What You Can Do

You can’t eliminate contextual scams, but you can narrow their effectiveness. That’s why you should always practice healthy habits that help you keep your assets safe.

Separate execution environments the same way you separate wallets. Moreover, use one setup for observation and another for signing. If the UI tells you something unexpected, verify it through an independent path before acting.

Slow down when context changes. Speed is fine for known, repeatable actions. However, it’s dangerous when the flow deviates. The scam depends on you treating a new situation like an old one.

Finally, recovery, migration, and emergency actions are the highest-risk moments. Treat them as adversarial by default, even when they originate from familiar brands or communities.

These steps don’t eliminate the possibility of being scammed. However, they make them harder to complete without detection.

Stay Vigilant as Scams Evolve

AI-generated interfaces will improve visual fidelity and personalization. Also, attackers will increasingly exploit legitimate incidents rather than invent fake ones. Infrastructure compromises will matter more than contract bugs.

False security will grow as wallets add warnings and simulations that can themselves be spoofed or contextually bypassed. Meanwhile, enforcement pressure will push users toward fewer, larger platforms, increasing the impact of any single compromise.

Frequently Asked Questions

A transaction can be technically correct while the surrounding context is manipulated. The blockchain records execution, not deception. If parameters, approvals, or routing are altered before signing, the outcome can be harmful even though the transaction itself is legitimate.

Attackers design scams to blend into expected workflows. By guiding users through familiar actions such as retries, reconnects, or upgrades, the interaction feels routine, which lowers skepticism and increases compliance.

Front ends, RPC endpoints, analytics widgets, and dashboards all shape how users interpret transactions. If any layer is compromised or spoofed, users may receive accurate on-chain data presented in a misleading way.

Wallet warnings focus on contract risk, not situational manipulation. If the transaction matches known patterns and contracts, simulations can appear safe even when the broader interaction flow has been distorted.

Risk is highest during recovery events, migrations, congestion issues, or emergency fixes. These moments introduce urgency and deviation from normal behavior, which attackers exploit to bypass user caution.

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

Peter Schiff Warns of a U.S. Dollar Collapse Far Worse Than 2008

2Dubai Insurance Launches Crypto Wallet for Premium Payments & Claims

3XRP Whales Buy The Dip While Price Goes Nowhere

4Samsung crushes Apple with over 700 million more smartphones shipped in a decade

5Luxury Meets Hash Power: This $40K Watch Actually Mines Bitcoin

Latest

Also read

Similar stories you might like.