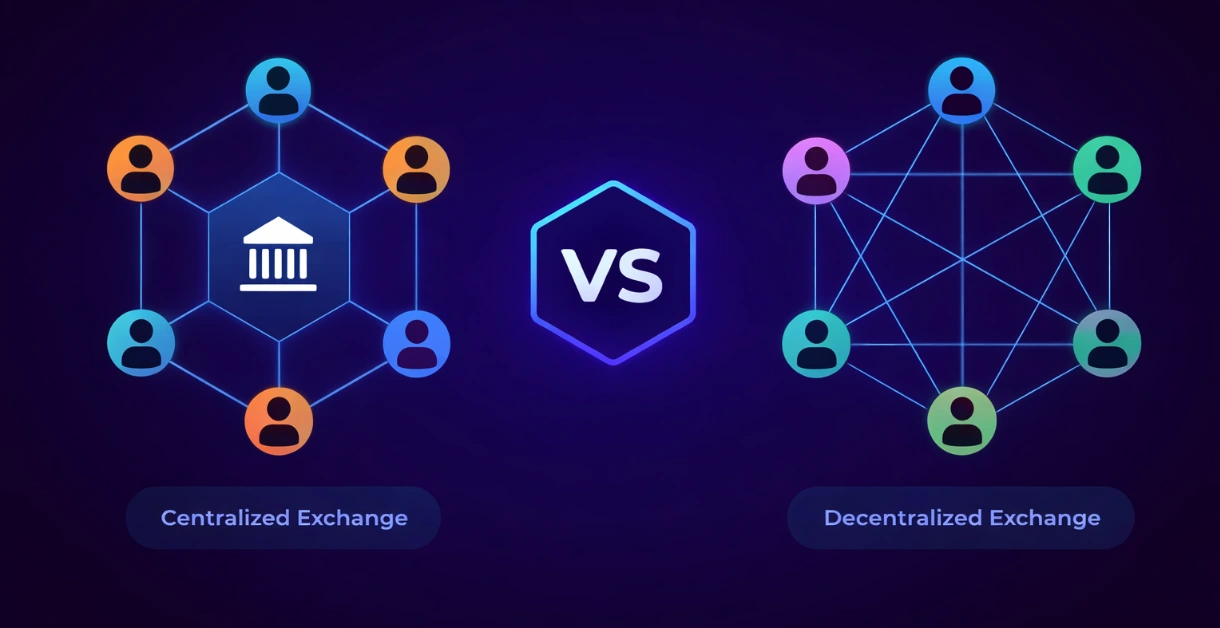

Diagram of centralized exchanges vs decentralized showing centralized linked to the same entity that executes the operations while decentralized shows users performing peer to peer transactions

Centralized Vs Decentralized Exchanges: A Quick Guide

In Brief

- • Centralized exchanges offer simplicity and support, while decentralized platforms prioritize control and financial independence.

- • Beginners often start with CEXs for ease of use, then move toward DEXs as confidence and knowledge grow.

- • The real decision isn’t CEX vs DEX, it’s convenience versus responsibility and how much control you want over your crypto.

When you step into cryptocurrency, one important decision is where to trade. Should you use a centralized exchange such as Coinbase or Binance, or explore decentralized platforms like Uniswap or PancakeSwap? Both allow you to perform similar transactions but operate in different ways.

For beginners, understanding the difference goes beyond a technical standpoint. Choosing one or the other shapes how you interact with crypto every day.

Furthermore, the choice between centralized and decentralized platforms reflects your priorities as a user.

Centralized Exchanges in Everyday Life

Centralized exchanges (CEX) function like traditional financial institutions. You create an account, verify your identity, and deposit funds. The platform holds custody of your assets and matches buyers and sellers.

Buying Bitcoin on a centralized exchange is as simple as linking a bank account, card, or just performing an on-chain transaction that funds your account. Also, the interface resembles online banking, making the process intuitive.

A very important detail is that liquidity is deep, so trades are executed quickly. Customer support is also available if you make a mistake, which is reassuring when you are new.

Yet, like most platforms, centralized exchanges come with trade‑offs. You don’t fully control your funds because the platform holds your keys. Therefore, if the exchange is hacked or freezes accounts, you may lose access.

CEXs are also subject to government regulations, which can affect how and where you trade. Given these fundamental aspects, beginners must weigh convenience against control.

Decentralized Platforms as an Alternative

Decentralized exchanges operate directly on the blockchain using smart contracts. Instead of depositing funds into a company’s account, you connect your wallet and trade peer to peer.

For beginners, decentralized platforms represent independence, given that you can keep control of your private keys and funds. Also, no identity verification is required, offering greater privacy. Transactions are transparent and executed by code rather than intermediaries.

However, decentralized platforms can prove to be intimidating. Interfaces may seem complex, and every transaction requires blockchain gas fees that the user needs to cover.

Mistakes are irreversible, and there usually isn’t reliable customer support to fix errors. Beginners must learn to manage their own wallets and security, which can feel overwhelming during the early stages of their crypto journey.

Everyday Scenario: Choosing Between CEX and DEX

Imagine you want to send money abroad. On a centralized exchange, you might simply withdraw funds to a bank account and then perform a regular fiat transfer. On DEX however, you would send tokens directly to another wallet. Both methods work, but the experience is different and your decision might be influenced by the payment method you’re using at the moment.

Beginners quickly see how each option fits different needs.

Another scenario involves trading during volatile markets. On a centralized exchange, you can quickly sell assets and move into stablecoins with a few clicks.

On a decentralized platform, you may need to navigate liquidity pools and pay gas fees, which can be more complex and take longer. Also, you might need to manually increase your slippage tolerance to execute transactions.

The Advantages of Centralized Exchanges

As mentioned above, there are multiple ways that CEXs make the process of trading crypto a more intuitive and reliable one. However, its main features stand out when it comes to everyday use.

They allow beginners to purchase cryptocurrency with fiat money, making the transition seamless. Liquidity ensures trades are fast, and customer support provides reassurance.

For example, a beginner who wants to buy Bitcoin for the first time can do so in minutes on a centralized exchange. The process is simple, and the platform guides you through each step.

This ease of use makes centralized exchanges the most common starting point for newcomers. However, it still doesn’t offer full control over assets, if something happens to the exchange it may affect your funds as well.

The Advantages of Decentralized Platforms

Decentralized platforms empower users to control their own funds. Privacy is greater because no identity verification is required. Therefore, beginners who value independence often gravitate toward these platforms once they gain confidence.

Decentralized platforms also align with the philosophy of crypto, which emphasizes decentralization and peer‑to‑peer transactions. Essentially, learning to use a decentralized platform is a step toward understanding the full potential of blockchain and DeFi.

Imagine a beginner who has grown comfortable with crypto wallets and understands them properly. They connect to a decentralized platform and swap tokens directly and with complete control. There’s a sense of ownership because their holdings are no longer dependent on a company to manage their funds.

The Future of Exchanges

The future of crypto trading will continue to involve both centralized and decentralized platforms. CEXs will continue to serve as gateways for beginners, offering fiat access and customer support.

On the other hand, DEXs will grow as users seek greater independence and privacy. In the end, both platforms represent two sides of the same coin, with CEXs prioritizing convenience and DEXs prioritizing control.

Therefore, beginners should start where they feel comfortable but strive to understand both. By learning the strengths and weaknesses of each, you can navigate the crypto ecosystem with confidence.

Frequently Asked Questions

Centralized exchanges hold your funds and manage trades for you, while decentralized platforms let you trade directly from your own wallet without giving up custody.

Most beginners start with centralized exchanges because they’re easier to use, support fiat payments, and offer customer support, then explore decentralized platforms later.

Not fully. If the exchange controls the private keys, you rely on the platform to access your funds and are exposed to exchange-related risks.

Slippage tolerance is the maximum price difference you’re willing to accept during a swap, protecting your trade from failing or executing at a much worse price during volatility.

Because trades are executed directly on the blockchain by smart contracts, there’s no customer support or reversal once a transaction is confirmed.

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

Peter Schiff Warns of a U.S. Dollar Collapse Far Worse Than 2008

2Dubai Insurance Launches Crypto Wallet for Premium Payments & Claims

3XRP Whales Buy The Dip While Price Goes Nowhere

4Luxury Meets Hash Power: This $40K Watch Actually Mines Bitcoin

5Samsung crushes Apple with over 700 million more smartphones shipped in a decade

Latest

Also read

Similar stories you might like.