Bitcoin coin, gold bullion and U.S. dollar. Source: TechGaged / Shutterstock

Bitcoin Would Need to Reach $1.7M per BTC to Match Gold’s Market Cap

In Brief

- • Gold’s ~$35T market cap highlights Bitcoin’s remaining capital gap.

- • Parity with gold implies roughly ~$1.78M per BTC under the base case.

- • The model compares market scale — not future price predictions.

Gold currently holds an estimated market capitalization of around $35 trillion, maintaining its position as the world’s largest store-of-value asset. While Bitcoin is often compared to the precious metal as a digital store of value, TechGaged’s latest research suggests that the cryptocurrency would need to trade near multi-million-dollar levels to approach gold’s scale.

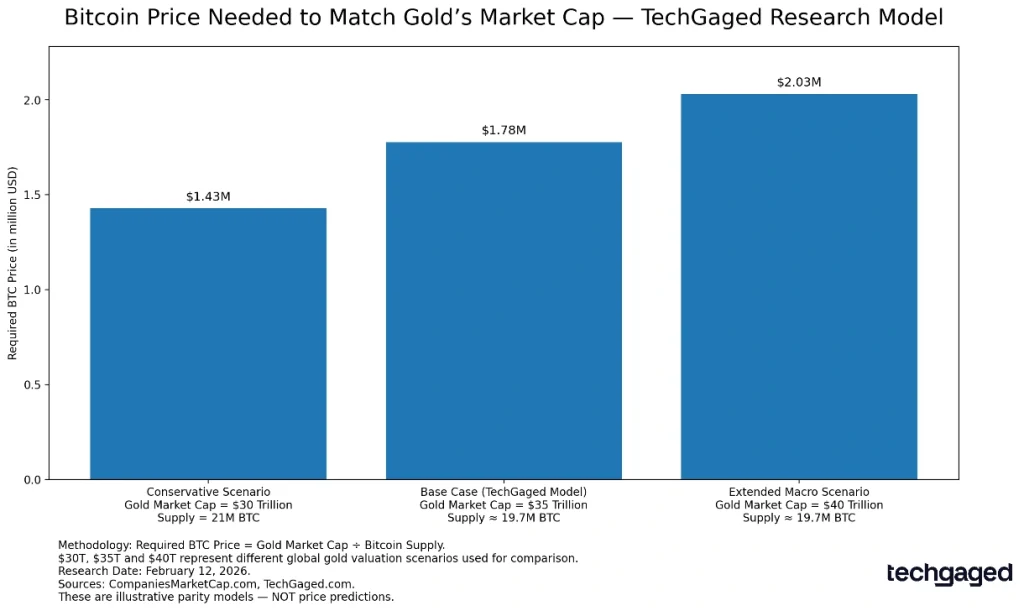

According to TechGaged.com‘s findings, Bitcoin would need to reach approximately $1.78 million per coin under a base-case scenario in which gold’s market capitalization is $35 trillion. The analysis uses a market-cap parity model rather than a price forecast, comparing Bitcoin’s circulating supply against different global gold valuation scenarios.

Understanding the Three Market Scenarios

The TechGaged Research chart outlines three possible gold market cap benchmarks:

- Conservative Scenario ($30T gold market cap, $1.34T BTC market cap): Bitcoin would need to reach roughly $1.43 million per coin, assuming a full 21 million supply.

- Base Case Model ($35T gold market cap, $1.34T BTC market cap): The required price rises to approximately $1.78 million per BTC, assuming an estimated current circulating supply of 19.7 million coins.

- Extended Macro Scenario ($40T gold market cap, $1.34T BTC market cap): A stronger global demand for gold would push the parity level closer to $2.03 million per Bitcoin.

Rather than predicting future prices, these scenarios illustrate the massive capital gap between traditional safe-haven assets and emerging digital networks.

A Broader Look at Today’s Markets

The global asset landscape indicates that investors are increasingly divided between two major themes: tangible safety and technological growth.

Precious metals remain at the top of the market-cap rankings, reflecting ongoing demand for stability amid macro uncertainty. At the same time, mega-cap technology firms — particularly those tied to artificial intelligence — continue to absorb enormous flows of capital.

Bitcoin sits between these two narratives. Its volatility and correlation with risk assets often align it with technology stocks, yet its long-term narrative continues to draw comparisons to gold as a hedge against monetary expansion.

Why the Gap Matters

The difference between Bitcoin’s current valuation and gold’s scale is not just about price — it represents decades of institutional trust, central bank reserves, and deeply liquid markets supporting the precious metal.

Market-cap parity models highlight that Bitcoin remains early in the broader global financial system. Even under optimistic assumptions, matching gold’s size would require a structural expansion in adoption, liquidity, and institutional participation rather than short-term speculative demand.

Digital Gold — Or a New Asset Class?

The findings also reinforce a growing debate within crypto markets: whether Bitcoin is evolving into a digital version of gold or forming a distinct asset class.

As macro conditions shift and capital rotates between safe havens and growth sectors, Bitcoin’s role continues to evolve somewhere between a technology network and a monetary alternative.

For now, the numbers presented in the research chart underscore a simple reality: while Bitcoin has reshaped the conversation around digital scarcity, gold still defines the scale of global store-of-value assets.

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

White House Urges Stablecoin Deal, Sets the Deadline as Debate Continues

2Ethereum Whales Cut Holdings as Retail Share Hits Record, Signaling Market Shift

3Turning Point: Bitcoin Drops Into Rare Oversold Territory Last Seen During the COVID Crash

4Goldman Sachs Boosts XRP Exposure As Retail Hesitates

5Bitmine Continues Accumulating Ethereum as Holdings Expand

Latest

Also read

Similar stories you might like.