Bitcoin logo displayed on a smartphone with a price chart in the background. Source: TechGaged / Shutterstock

Bitcoin Liquidity Drain Sparks Fears Of Rally Slowdown

In Brief

- • Liquidity data suggests crypto momentum may be fading.

- • Analysts warn rallies stall without fresh capital inflows.

- • Debate grows over rotation into gold.

A new liquidity chart is raising uncomfortable questions about the cryptocurrency market’s next move. The data suggests that the capital pool that helped fuel recent Bitcoin (BTC) and XRP rallies may now be fading. One analyst argues the shift could reshape short-term market momentum if fresh liquidity fails to step in.

Liquidity Signals Turning Cautious

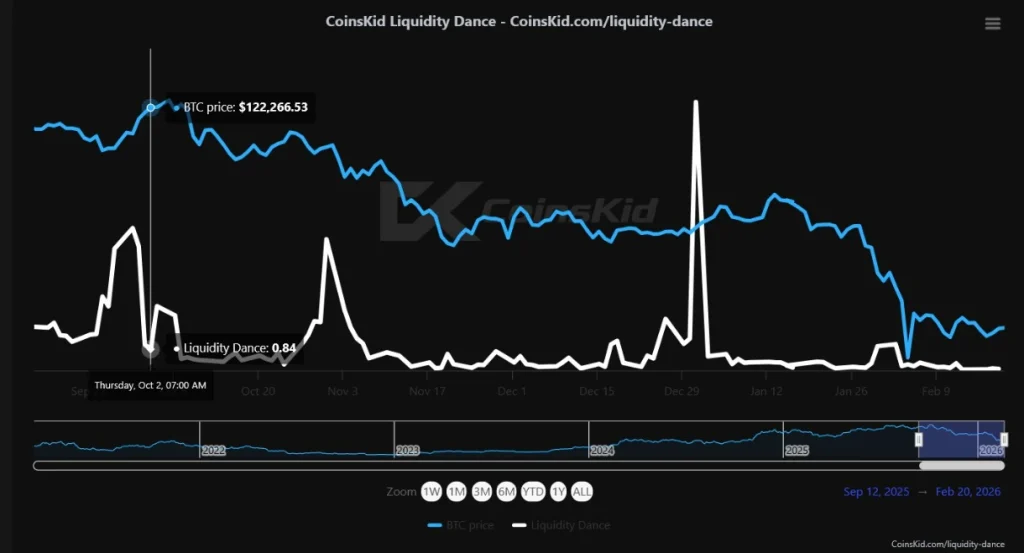

Indeed, the chart, shared by popular crypto trading expert CoinsKid on February 20, compares Bitcoin price action with a “liquidity dance” indicator that tracks capital rotation across markets. According to the analysis, past rallies coincided with spikes in available liquidity, while fading liquidity often preceded weaker price performance.

Recent readings show that this pool of capital has been steadily declining. That has led some traders to argue that the strong upside seen earlier in the cycle may have already consumed much of the available buying pressure.

Liquidity is often the hidden engine behind crypto rallies. Even bullish technical setups can stall if new money stops entering the market. When liquidity tightens, price moves tend to become choppier, and breakouts are harder to sustain.

Meanwhile, Bitcoin is currently changing hands at the price of $67,551.43, up 1.9% in the last 24 hours, down 0.8% across the past seven days, and losing 25.2% over the month, per the latest chart data.

Gold Versus Crypto Debate Returns

The latest commentary has also revived an old debate around the issue of where capital rotates to next when crypto liquidity fades.

Some analysts believe money could temporarily shift into traditional safe havens like gold. This argument is based on the assumption that, when risk appetite cools, capital tends to flow toward assets perceived as more stable.

That does not automatically mean a long-term bearish shift for crypto. Markets frequently move in cycles where liquidity rotates between sectors rather than disappearing entirely.

For crypto bulls, the key question now is timing. If fresh liquidity re-enters through institutional flows, exchange-traded fund (ETF) demand, or macro tailwinds, the market could regain momentum quickly. If not, the path higher may become slower and more volatile.

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

Rising U.S. Debt Fears Fuel XRP Bull Case – What’s Happening?

2CME Group Expands Into 24/7 Crypto Trading in Major Shift

3Ethereum Prepares Massive 2026 Network Overhaul – What’s Coming?

4Bitcoin Coiling Hard, Traders Brace For Move

5Solana Sentiment Implodes But Shorts May Regret It – Here’s Why

Latest

Also read

Similar stories you might like.