Solana coin. Source: TechGaged / Shutterstock

Solana Sentiment Implodes But Shorts May Regret It – Here’s Why

In Brief

- • Solana sentiment and social dominance have collapsed.

- • Bearish charts contrast with rising network activity.

- • Heavy short positioning raises squeeze risk.

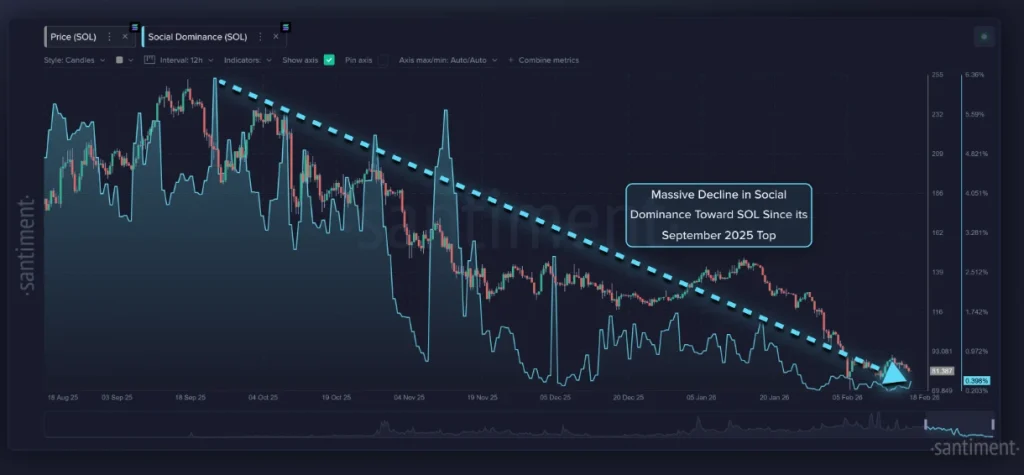

Solana’s social dominance has plunged below 0.4%, down sharply from over 6% during its 2025 peak when SOL traded near $249. The drop reflects a brutal sentiment reset as the token remains about 67% below its highs. But under the surface, the signals are not as one-sided as they seem.

The decline in hype follows a turbulent period for the network. Urgent validator patches earlier this year exposed coordination challenges across Solana’s decentralized infrastructure, forcing developers to push rapid fixes for vulnerabilities related to node stability and vote processing.

Markets tend to react fast when upgrades are labeled critical, because uptime and finality directly affect capital moving through decentralized finance (DeFi).

Bearish Charts Meet Bullish Undercurrents

Technically, the picture still leans heavy. Former support in the low $100 range has flipped into resistance, while RSI readings near the low 30s suggest weak momentum, according to the data shared by blockchain monitoring platform Santiment on February 19.

Specifically, SOL is currently changing hands at the price of $81.61, recording a decline of 3.8% in the last 24 hours, losing 0.5% across the past seven days, and accumulating a drop of 36.7% over the last month, per the most recent chart information.

Some traders warn that sustained selling pressure could open the door to a deeper move toward the $50 to $60 range if macro conditions stay hostile.

Yet derivatives data tells a different story. Funding rates across exchanges have turned deeply negative, signaling aggressive short positioning. Historically, crowded shorts often create the conditions for sharp reversals, especially if liquidations cascade during even modest upside moves.

Similar setups have previously fueled fast recoveries in altcoins during periods of peak pessimism.

On-chain activity adds another wrinkle. Despite falling prices, daily network growth has continued climbing, with new wallets steadily increasing over recent months. That divergence between price and usage suggests Solana’s underlying activity has not dried up, even as retail enthusiasm may have faded.

The result is a rare split narrative. Sentiment is battered, charts remain fragile, and infrastructure debates continue. But rising network growth and extreme short positioning hint that the story may still be unfolding. For traders, Solana now sits in an uncomfortable zone where fear dominates headlines while signals quietly diverge beneath the surface.

Solana Price Today

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Also read

Similar stories you might like.