CIRCLE logo shows on a screen with a dark tech background. Source: TechGaged / Shutterstock.

Circle Says Stablecoin Regulation Has Reached an Inflection Point

In Brief

- • Circle says 2025 marks a regulatory inflection point for stablecoins globally.

- • The company argues legal clarity is moving institutions from pilots to real deployment of USDC.

- • Stablecoins are positioned as compliant infrastructure for payments, treasury, and tokenised markets.

Circle says stablecoin regulation has entered a decisive phase in 2025, with major jurisdictions moving regulated digital dollars inside the formal financial system. The company argues that frameworks such as the GENIUS Act in the United States are creating clear legal foundations for stablecoins like USDC.

This shift is enabling institutions to transition from pilot programs to real-world deployment across payments, treasury management, and capital markets infrastructure.

Moreover, they frame regulations not as a constraint, but as the catalyst accelerating adoption of internet-native financial rails backed by compliant digital dollars.

Regulation as the Catalyst for Institutional Adoption

Circle states that regulated stablecoins are now being integrated directly into the financial system under defined supervisory standards.

The company highlights that 2025 marked a structural turning point. Where policy clarity reduces uncertainty for banks, fintechs, and multinational corporations evaluating blockchain-based settlement tools.

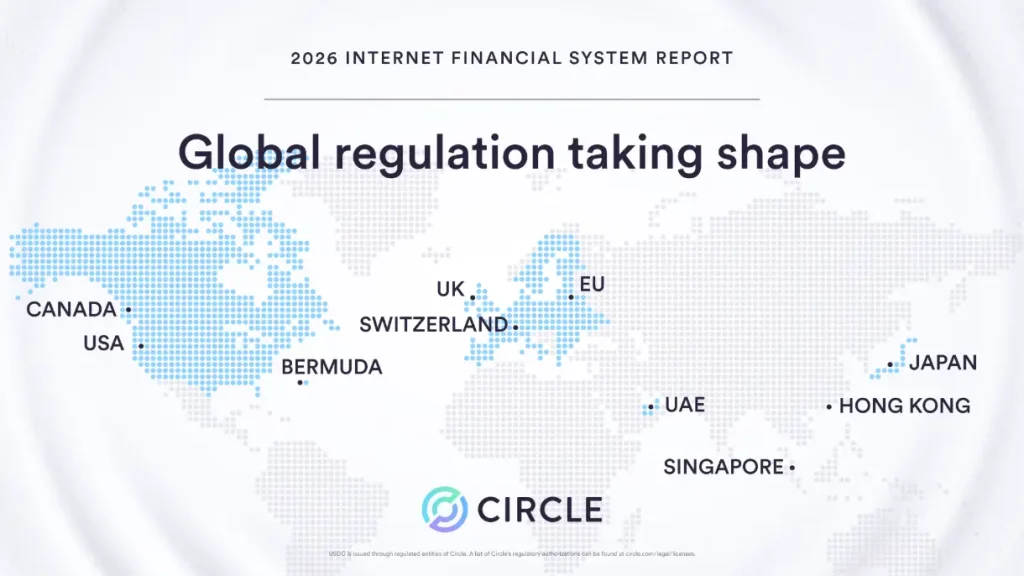

Furthermore, Circle emphasizes that USDC is available globally and structured to meet evolving regulatory requirements across multiple jurisdictions.

The report outlines how legal clarity allows institutions to move beyond experimentation into operational deployment.

Indeed, it aids cross-border payments, on-chain treasury operations, programmable settlement, and tokenized financial instruments.

The company describes stablecoins as foundational infrastructure for what it calls the “Internet Financial System.”

Importantly, Circle also mentions geographic progress. Noting that regulatory frameworks are advancing across North America, Europe, the UK, and Asia-Pacific financial hubs.

Therefore, the company frames this convergence as a coordinated global movement toward harmonised standards for digital dollar instruments.

From Pilot Programs to Real-World Finance

Today, Stablecoins are being used in treasury operations for faster settlement cycles, improved liquidity management, and programmable compliance controls.

Moreover, regulatory alignment reduces systemic risk by embedding identity, transparency, and governance mechanisms into blockchain-based value transfer systems.

Circle positions regulated stablecoins as a bridge between traditional finance and blockchain networks.

As a result, they believe the next phase of growth will happen thanks to institutions leveraging compliant digital dollars to modernise global financial infrastructure.

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

Gravestone Doji: XRP Just Flashed a Brutal Historical Signal

2Crypto.com Becomes First Crypto Platform to Achieve This Certification

3Ethereum ICO Wallet Awakens After 10 Years – What Happened?

4$2.3 Billion Vanished in Bitcoin Losses. History Says This Moment Matters

5SBI Holdings CEO Denies $10B XRP Holdings

Latest

Also read

Similar stories you might like.