XRP coin stack. Source: TechGaged / Shutterstock

XRP Network Activity Drops 26% in a Week – Trouble Mounting?

In Brief

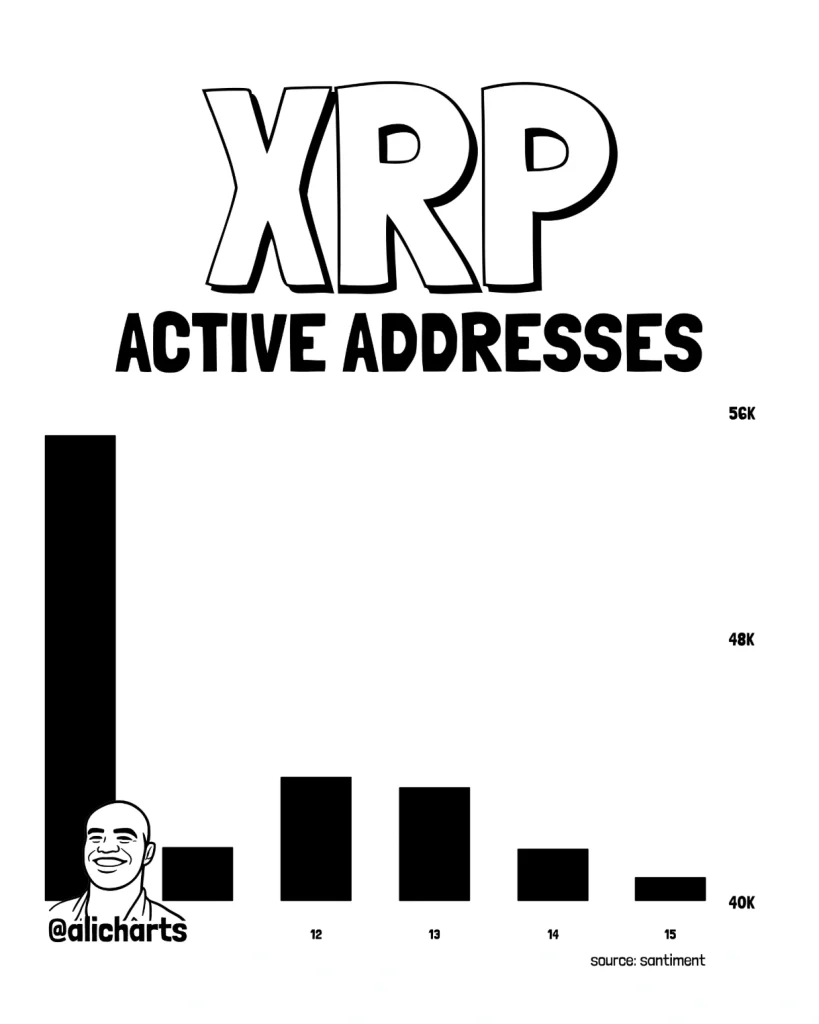

- • XRP active addresses fell ~26% in one week.

- • Dropped from ~55K to ~40.7K users.

- • Suggests cooling short-term network activity and momentum.

XRP network activity has sharply declined over the past week, with active addresses dropping nearly 26%. On-chain data shows the count falling from around 55,000 to just over 40,700 addresses. The slowdown could signal weakening short-term demand as traders monitor broader XRP momentum.

XRP Activity Falls Sharply On-Chain

Indeed, XRP network engagement has cooled significantly, according to new on-chain data tracking active addresses, shared by renowned cryptocurrency trading expert Ali Martinez in an X post on February 17.

The number of active XRP addresses reportedly dropped from roughly 55,080 to 40,778 within a week, marking a decline of nearly 26%. Active addresses are commonly used as a proxy for user participation and real network demand, making sharp changes a closely watched signal for traders.

What Active Address Declines Mean

A drop in active addresses typically reflects lower transaction activity, user engagement, network throughput, and speculative participation. Though not always bearish on its own, sustained declines can indicate fading short-term momentum, especially during periods of price consolidation or uncertainty.

Historically, major trends in crypto markets are often accompanied by rising on-chain activity, whereas cooling participation can coincide with slower price action.

Currently, XPR is changing hands at the price of $1.45, which suggests a decline of 2.8% in the last 24 hours, a 3.8% increase across the past seven days, and an accumulated decline of 29.2% over the month, per the most recent chart information.

Possible Drivers Behind The Drop

Several factors could be contributing to the slowdown in XRP activity, including reduced retail trading interest, broader market consolidation, declining speculative flows, and short-term profit-taking.

Network activity metrics can also fluctuate due to exchange movements, whale inactivity, or temporary liquidity shifts.

What This Means For XRP Traders

For traders, declining activity can serve as an early warning signal, though context is key. Lower engagement may suggest weakening near-term momentum, reduced volatility, slower capital rotation, and a potential consolidation phase.

However, activity dips don’t automatically imply bearish price action. In some cases, reduced participation precedes larger directional moves as liquidity resets.

A Signal To Watch, Not A Verdict

On-chain metrics like active addresses are best observed alongside price structure, volume, and broader market sentiment.

If activity continues trending lower, it could reinforce a cooling market phase for XPR. But a rebound in address activity would likely signal renewed interest and stronger participation returning to the network.

Bottom Line

XRP’s active address count has dropped nearly 26% in a week, which is a notable shift in on-chain participation. Though not a standalone bearish signal, the decline points to cooling engagement that traders will be watching closely. The next move in network activity could help shape XRP’s short-term outlook.

XRP Price Today

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

Gravestone Doji: XRP Just Flashed a Brutal Historical Signal

2Crypto.com Becomes First Crypto Platform to Achieve This Certification

3Ethereum ICO Wallet Awakens After 10 Years – What Happened?

4SBI Holdings CEO Denies $10B XRP Holdings

5$2.3 Billion Vanished in Bitcoin Losses. History Says This Moment Matters

Latest

Also read

Similar stories you might like.