Smart Cashtags will let its billion‑user base trade Bitcoin and stocks directly from the timeline.

Something Big Is Coming to Your X Feed, and It Involves Bitcoin

In Brief

- • X will let users trade crypto and stocks directly from the timeline.

- • Smart Cashtags link social sentiment with real-time market execution.

- • The move advances X’s vision of becoming a full financial super-app.

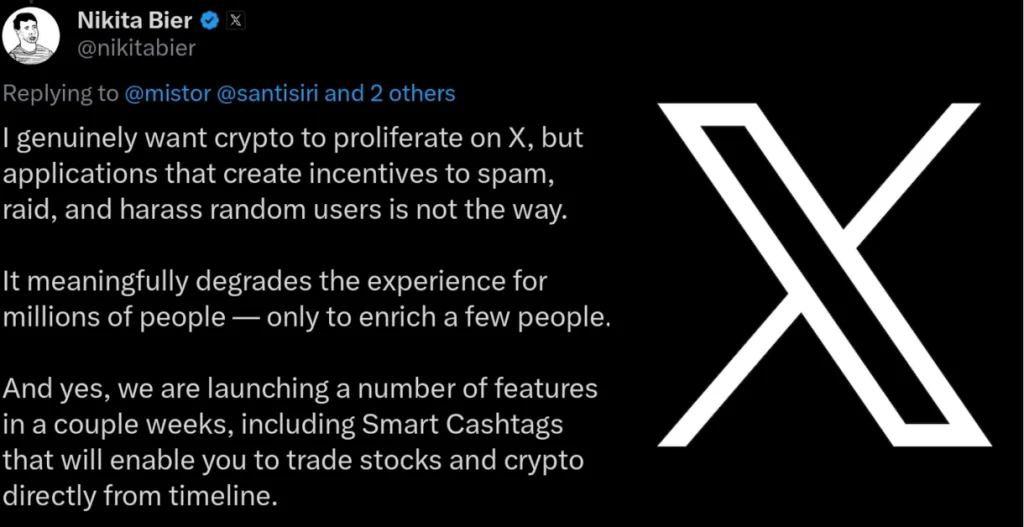

X is preparing to fuse social media with live trading. According to statements from Nikita Bier, the platform will roll out Smart Cashtags within weeks.

As a result, users will trade Bitcoin, crypto, and stocks directly from the timeline. This launch targets X’s one-billion-plus users and advances the push to become an everything app.

At a functional level, Smart Cashtags upgrade familiar tickers into interactive objects. For example, tapping $BTC opens live prices, charts, and execution.

Consequently, discovery, analysis, and action occur in one flow. X already hosts market talk at scale. Now, it plans to let users act instantly, without app switching.

Importantly, this move reframes X’s role. Rather than amplify conversation alone, X becomes a distribution layer for financial activity.

Attention already lives on the feed. Therefore, execution follows attention.

Social Sentiment Meets Real-Time Markets

Historically, traders treated X as a sentiment engine. News breaks there first. Opinions spread fast. Prices often follow.

With Smart Cashtags, that loop tightens. Now, users can act seconds after spotting a ticker.

As a consequence, friction drops across retail trading. Faster execution can convert sentiment into volume quickly.

In turn, volatility may rise around headlines, earnings, or macro prints. Retail flows could cluster around viral narratives.

At the same time, information quality may improve. Instead of passive reading, users can validate claims with live data. Charts and prices appear at the moment of debate.

Therefore, misinformation may lose ground, even as conviction strengthens.

From a structure standpoint, X becomes a real-time signal amplifier. Sentiment, data, and execution converge. Accordingly, reaction cycles compress across crypto and equities.

X’s Financial Stack Starts Taking Shape

Beyond trading, Smart Cashtags hint at deeper infrastructure. X already explores payments through X Money. Trading adds another layer.

Together, these features outline a stack: discovery, execution, and settlement.

Consequently, regulatory demands rise. Trading inside a social app requires controls for disclosures, execution quality, and market integrity.

Partnerships with licensed brokers and custodians become essential. Jurisdictional rules will matter.

Nevertheless, the strategy looks deliberate. Instead of building finance separately, X embeds it where engagement exists.

This mirrors super-app growth patterns seen in Asia, not legacy Western brokerages.

Moreover, tighter API rules aim to curb spam and manipulation. By doing so, X protects user experience as financial features scale. That balance matters for trust.

Ultimately, this launch reframes behavior. X no longer just shapes markets through conversation. It aims to mediate participation.

If Smart Cashtags scale as planned, the timeline evolves. It becomes more than a feed. It becomes a trading terminal.

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

White House Urges Stablecoin Deal, Sets the Deadline as Debate Continues

2Ripple Just Expanded Escrow Beyond XRP – Here’s What That Could Unlock

3The Netherlands Approved a Tax That Could Force Investors to Sell

4Solana Reclaims Structure as Activity Improves

5Bitcoin Would Need to Reach $1.7M per BTC to Match Gold’s Market Cap

Latest

Also read

Similar stories you might like.