Bitcoin’s 2025 peak raises new questions about gold and silver’s next move.

Bloomberg’s McGlone Says Bitcoin’s 2025 Peak Signals Trouble For Metals

In Brief

- • A Bloomberg analyst compares crypto’s drop to the 1929 crash.

- • He says volatility remains elevated despite bottom signals.

- • Crypto may lag metals in the near term.

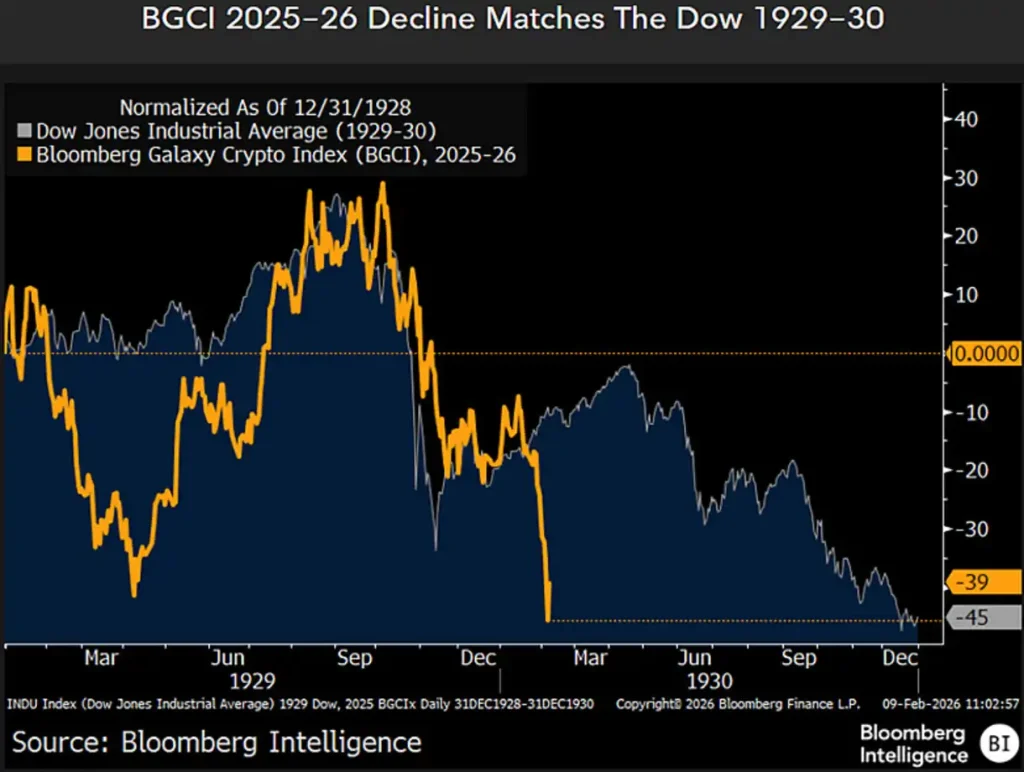

Bloomberg Intelligence’s Mike McGlone is drawing one of the boldest historical parallels yet: the Bloomberg Galaxy Crypto Index (BGCI) has fallen roughly 45% in 2025-26, matching the Dow Jones Industrial Average’s decline during the 1929-30 crash.

That comparison, McGlone argues in an analysis he shared on X on February 10, may suggest the cryptocurrency market is approaching a cyclical bottom, but not without more volatility ahead.

A 1929 Parallel – With A Twist

According to McGlone, the 45% drop in the BGCI closely tracks the Dow’s performance during the early stages of the Great Depression. Historically, such sharp declines often precede powerful bear-market rallies.

However, he adds a key difference: crypto trades at roughly double the volatility of the Dow during 1929-30. In other words, any rebound could be sharp, but so could further downside.

He also emphasizes a structural distinction. Unlike stocks in 1929, crypto faces what he calls an “effectively unlimited supply” dynamic, with thousands of tokens competing for capital. That changes how recovery cycles may unfold.

Crypto vs. Metals: A Key Support Break

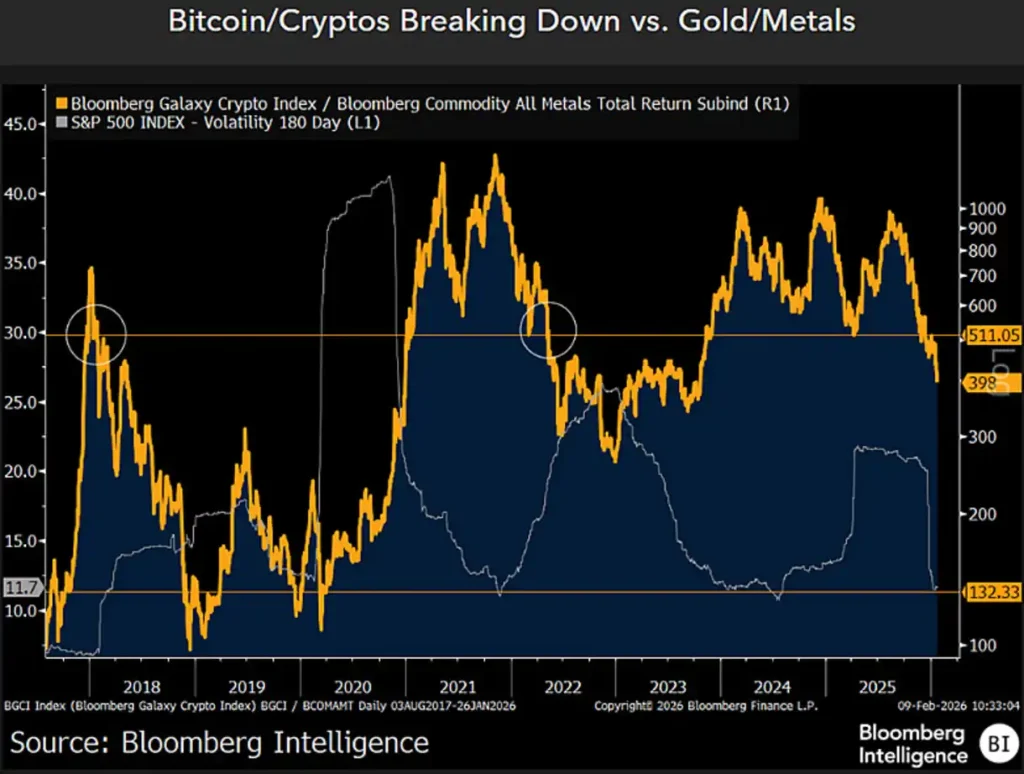

In a separate analysis, McGlone highlighted a technical breakdown in the ratio of the BGCI versus the Bloomberg All Metals Total Return Index.

The ratio has slipped below a key pivot level around 510, a former resistance level dating back to 2018. Traditionally, losing such levels would suggest momentum may continue in the direction of the break.

For investors, that means crypto could remain under pressure relative to gold, silver, and industrial metals through 2026.

Bitcoin’s 2025 Peak And What It Signals

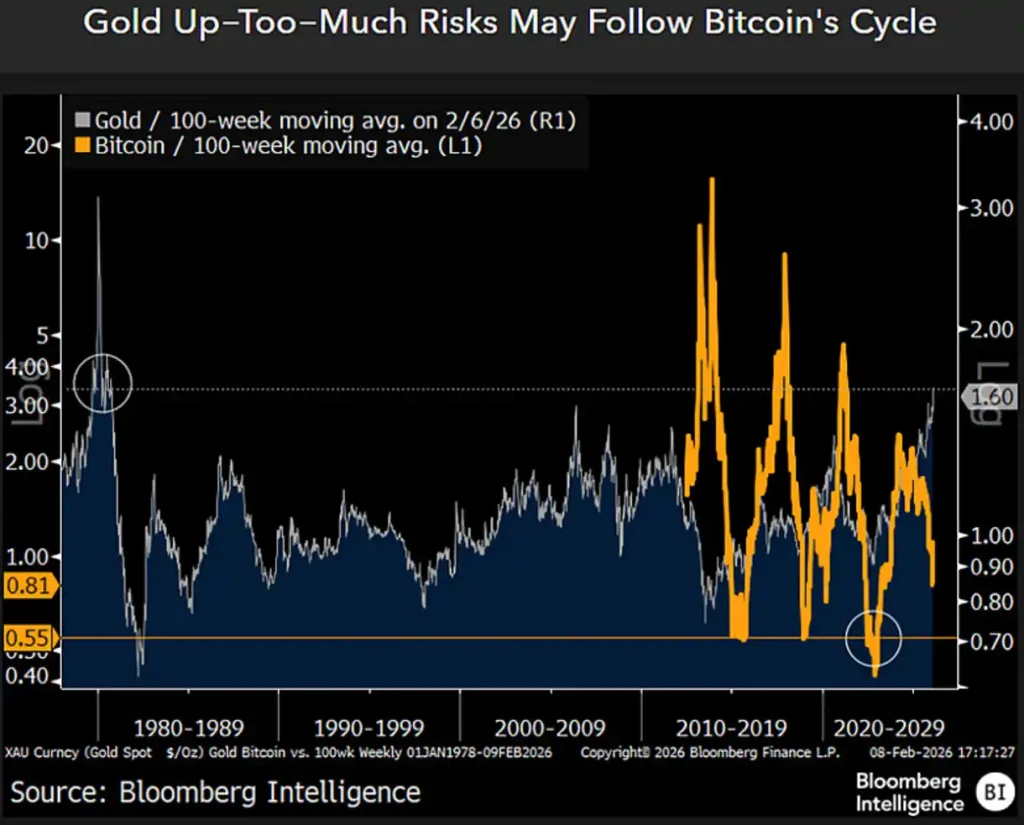

McGlone also compared crypto’s 2025 “up-too-much” surge to a potential warning for metals markets in 2026.

His thesis is that extreme price expansions often cure themselves. Bitcoin’s prior cycle peaks may serve as a template for how gold and other metals behave if U.S. stock market volatility normalizes.

At the moment, the first asset in the crypto industry is trading at $66,981.71, down 2.8% on the day, declining 11.9% across the week, and accumulating a decline of 25.9% over the past month, according to the most recent price charts.

All things considered, McGlone expects sharp rallies typical of bear markets, but warns that volatility and supply dynamics make crypto’s path forward far from predictable.

For traders and long-term holders alike, the 1929 comparison isn’t just dramatic, it’s a reminder that markets often recover, but rarely in a straight line.

Bitcoin Price Today

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

LINK Futures Go Live on CME Group

2Bitmine Continues Accumulating Ethereum as Holdings Expand

3Ethereum Switched On a New Standard That Changes How AI Uses Crypto

4Federal Reserve Downplays Bitcoin Volatility as Crypto Adoption Grows

5White House Urges Stablecoin Deal, Sets the Deadline as Debate Continues

Latest

Also read

Similar stories you might like.