Bitcoin stands in front of a chart showing a downtrend. Searching for stabilization as leverage unwinds.

Bitcoin’s Fall Just Erased Years of Gains. What Comes Next Matters

In Brief

- • Forced liquidations, not panic selling, drove Bitcoin’s sharp decline.

- • Leverage has been flushed, reducing immediate downside pressure.

- • Price now depends on spot demand and broader liquidity conditions.

Bitcoin has now erased every gain accumulated since its November 2021 all-time high near $69,000. After a sharp and accelerating selloff, BTC fell toward the low $60,000 range, marking a full structural reset of the post-ETF rally.

The decline was accompanied by more than $1.5 billion in liquidations across the crypto market within 24 hours. Also, BTC accounted for the largest share of forced closures.

Technically, Bitcoin lost multiple higher-timeframe support zones in rapid succession. Daily and weekly charts show price cutting through former value areas that held throughout 2024 and early 2025.

A Leverage Event, Not a Sentiment Collapse

Despite the severity of the price drop, underlying behavior points to mechanical pressure instead of a wider capitulation.

Moreover, open interest fell sharply during the selloff, signaling that leveraged positions were being flushed out.

On the other hand, funding rates cooled rapidly as longs were wiped out. Therefore, it removed the positive funding environment that had previously incentivized crowded positioning.

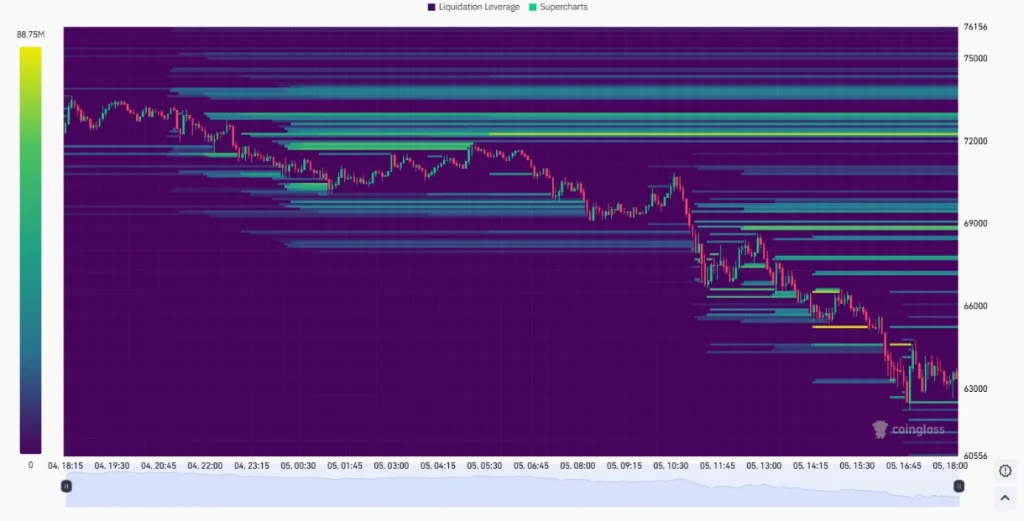

At the same time, liquidation heatmaps show sharp forced sells around key technical levels, reinforcing that this was a derivatives-driven event.

In past cycles, similar leverage resets often marked inflection points, not because price immediately recovers, but because distorted positioning fades away.

BTC/USDT Liquidation Heatmap

What Needs to Happen for Bitcoin to Bounce Back

For Bitcoin to stabilize and stage a meaningful relief rally, market structure must remain clean. Moreover, open interest needs to stay suppressed.

Indeed, any sharp rebuild in leverage would increase downside risk and reopen liquidation pathways.

Additionally, sell-side pressure must ease on-chain. Exchange netflows will be a critical metric to watch, given that a slowdown in inflows or a return to net outflows would signal that panic-driven transfers are fading.

With leverage reset and forced sellers largely exhausted, even modest spot demand can have an outsized impact on price.

$60,000 Matters More Than Any Indicator

The $60,000 region represents more than a psychological level. It aligns with prior macro consolidation zones, long-term moving averages, and areas where large amounts of volume were exchanged.

If Bitcoin becomes stable here, the market gets time to rebuild structure without leverage distortion.

Failure to hold, however, would risk turning this reset into a deeper trend shift driven by spot conviction loss and not derivatives pressure.

At this stage, Bitcoin’s next move is about whether structure can repair itself after one of the most aggressive liquidations since 2021.

Bitcoin Price Today

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Also read

Similar stories you might like.