Fear returns as crypto markets suffer a sharp $200B sell-off.

$200 Billion Wiped from Crypto Markets in 24 Hours: What’s Going On?

In Brief

- • Crypto markets saw a sharp sell-off, erasing nearly $200 billion in 24 hours.

- • Bitcoin and Ethereum fell as fear returned and selling pressure intensified.

- • Macro uncertainty and liquidity concerns are driving cautious market positioning.

Nearly $200 billion have been wiped from the cryptocurrency market in a single day, rattling traders across Bitcoin (BTC) and major altcoins.

The sell-off pushed sentiment firmly back into fear territory, reversing optimism that had built earlier this month. Behind the move is a mix of macro anxiety, policy uncertainty, and fading risk appetite, leaving traders to wonder if this is just another volatility shakeout or the start of a deeper reset.

Crypto Markets Slide as Fear Re-Emerges

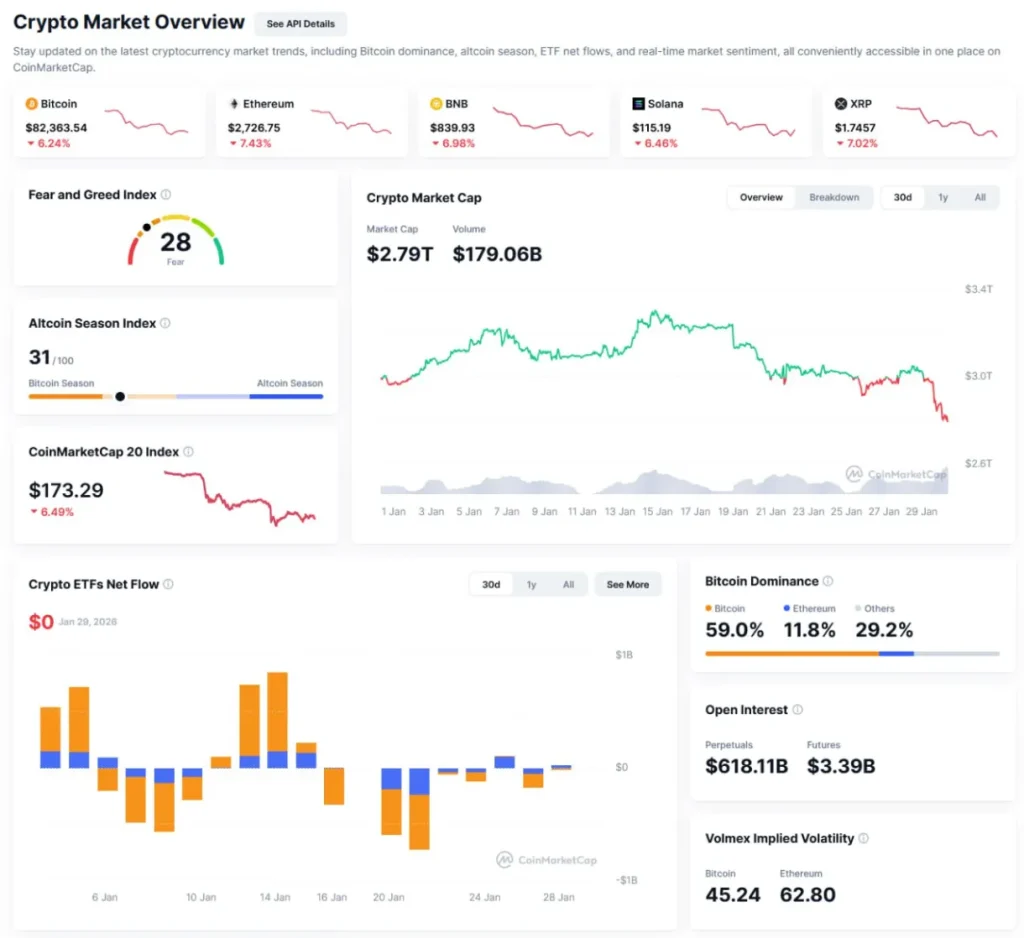

Data from CoinMarketCap shows total crypto market capitalization falling from roughly $2.98 trillion to $2.79 trillion in 24 hours. The decline dragged Bitcoin, Ethereum (ETH), and large-cap altcoins lower, and broader market indexes followed.

Bitcoin slipped toward $82,000, marking a fresh two-month low and extending a multi-month downtrend. Ethereum also slid below recent support, briefly trading near $2,730. Trading volumes stayed elevated, suggesting the move was driven by active selling rather than quiet drift.

Sentiment reflected the pressure. The Fear and Greed Index dropped to 28, a level typically associated with heightened caution and short-term risk aversion. Historically, readings in this zone coincide with deleveraging and defensive positioning rather than aggressive buying.

Why Macro Pressure Is Driving the Sell-Off

One catalyst gaining attention is speculation around the next U.S. Federal Reserve chair. Reports that former Fed Governor Kevin Warsh could replace Jerome Powell revived concerns about tighter liquidity conditions and a smaller Fed balance sheet.

Crypto has historically benefited from abundant liquidity, rallying when balance sheets expanded, and risk appetite followed. The prospect of that support fading has weighed heavily on speculative assets, including Bitcoin and Ethereum.

Exchange-traded fund (ETF) data reinforces the cautious tone. Spot Bitcoin ETFs recorded net outflows, signaling hesitation among institutional allocators. Though Ethereum-linked products saw modest inflows, the overall picture points to selective positioning rather than broad confidence.

The pullback also coincided with weakness in global risk assets. A sharp drop in major tech stocks, tied to renewed concerns around artificial intelligence (AI) spending, rippled through markets and added pressure to crypto.

For now, the message is that liquidity fears are back in focus and traders are reassessing risk just as volatility returns.

Bitcoin Price Today

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

Samsung crushes Apple with over 700 million more smartphones shipped in a decade

2Peter Schiff Warns of a U.S. Dollar Collapse Far Worse Than 2008

3Dubai Insurance Launches Crypto Wallet for Premium Payments & Claims

4XRP Whales Buy The Dip While Price Goes Nowhere

5Tether Launches USA₮, a Regulated Dollar-Backed Stablecoin

Latest

Also read

Similar stories you might like.