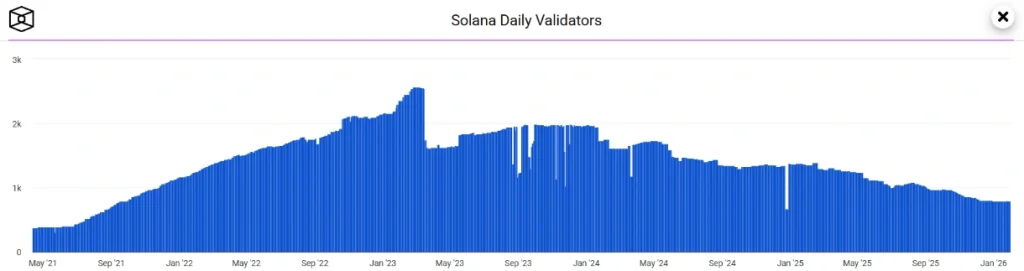

Solana’s validator network contracts as on-chain activity sharply declines.

Solana Validator Network Shrinks As Vote Transactions Plunge

In Brief

- • Solana’s validator participation is trending lower.

- • Vote transactions have dropped sharply, signaling reduced activity.

- • The data points to contraction, not a network crisis.

Fresh on-chain data is raising questions about Solana (SOL)’s current network participation, as the number of daily active validators on the blockchain has continued to trend lower into early 2026.

Indeed, this is what metrics tracked by Dune and aggregated by The Block show, at the same time indicating that vote transactions (a core indicator of validator participation), have dropped roughly 40%, pointing to reduced on-chain engagement rather than a short-term reporting anomaly.

What the Data Shows

Solana’s validator count peaked in early 2023 before entering a prolonged decline. Though the network still maintains hundreds of active validators, the downward trajectory has remained consistent across multiple market cycles.

Vote transactions are particularly important as they represent validators actively participating in consensus. A sharp reduction suggests fewer validators are either fully operational or economically incentivized to remain engaged.

This doesn’t necessarily signal network failure, but it does highlight a contraction phase. Validator economics on Solana have long been sensitive to fee revenue, hardware costs, and market conditions. When transaction demand slows, smaller or less efficient validators often exit first.

Structural Pressure, Not Panic

Importantly, the decline has been gradual rather than abrupt. There is no evidence of a sudden mass shutdown or coordinated validator exit. Instead, the trend reflects structural pressure across the broader crypto market, where reduced volatility and lower speculative activity translate into weaker on-chain incentives.

Solana’s high-performance design relies on consistent throughput to support validator sustainability. When usage cools, participation naturally tightens. This dynamic has appeared in other networks during consolidation phases, particularly after speculative cycles fade.

What to Watch Next

Validator counts alone don’t determine network health. Developers, users, and long-term infrastructure remain critical variables. However, sustained declines in participation can affect decentralization and resilience if not offset by renewed demand.

For now, the data suggests Solana is navigating a contraction rather than a crisis. Whether validation numbers stabilize or continue falling will depend on transaction growth, fee dynamics, and broader market recovery.

As with previous cycles, it’s activity as opposed to sentiment that will ultimately decide when participation turns back upward.

Solana Price Today

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Also read

Similar stories you might like.