Outside view of the White House in a bright setting with the US flag waving on the side. Source: TechGaged.

Missouri Bitcoin Reserve Bill Advances as Crypto Strategy Gains Ground

In Brief

- • Missouri’s HB 2080 would create a Bitcoin Strategic Reserve Fund managed by the state treasurer.

- • The bill allows BTC donations to be held for a minimum of five years.

- • Committee review is the next step before a potential House floor vote.

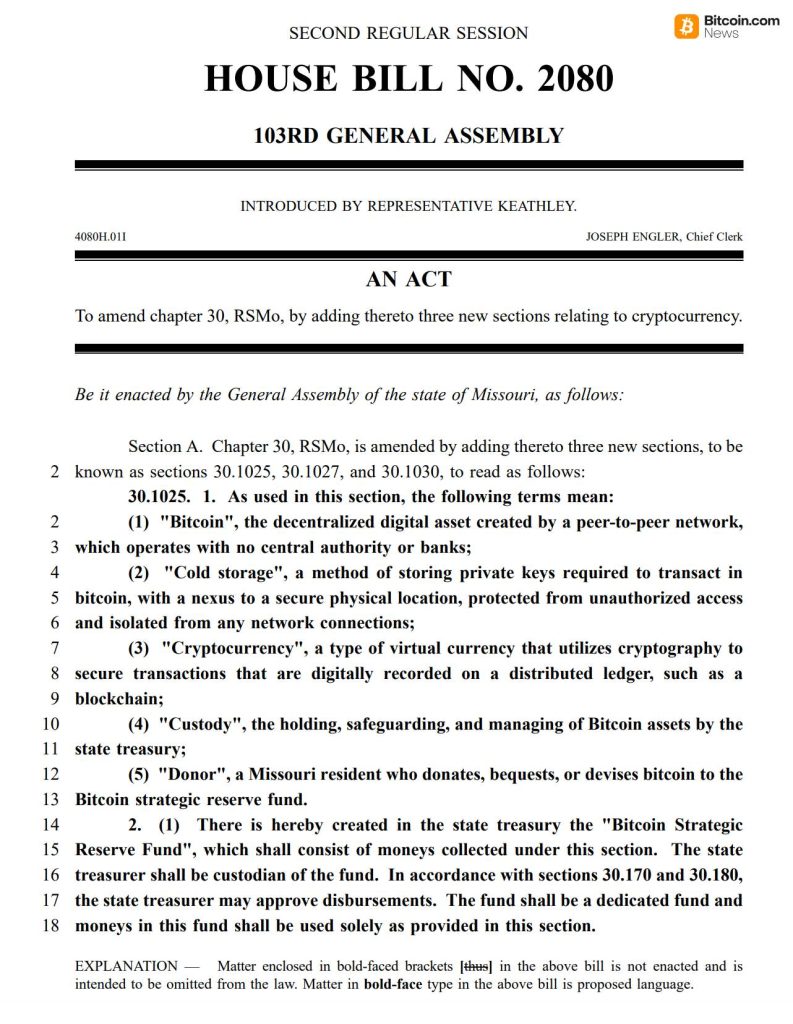

Missouri is moving closer to formally establishing a Bitcoin reserve framework. House Bill 2080, which would create a state-managed “Bitcoin Strategic Reserve Fund,” has advanced to the House Commerce Committee for further review.

The proposal would allow the Missouri state treasurer to accept and hold Bitcoin donations in a designated reserve fund for a minimum of five years.

If approved by committee, the bill could proceed to the House floor for debate.

While several U.S. states have explored crypto-related legislation, Missouri’s approach focuses on long-term custody, and not on immediate liquidation or short-term treasury allocation.

What Missouri’s HB 2080 Would Actually Do

HB 2080 amends Chapter 30 of Missouri statutes to formally recognize and define digital asset terms, including Bitcoin, cold storage, and cryptocurrency.

Moreover, the bill establishes a Bitcoin Strategic Reserve Fund within the state treasury, funded through voluntary donations, bequests, or devises of Bitcoin from Missouri residents.

Under the draft language, the treasurer would be responsible for custody and management of the Bitcoin assets. Therefore, funds must remain in the reserve for at least five years before potential use.

Importantly, the bill doesn’t mandate taxpayer-funded purchases of Bitcoin. Instead, it creates a legal framework to hold donated BTC within a state-controlled reserve structure.

State-Level Bitcoin Policy Is Gaining Attention

State-led crypto initiatives have accelerated over the past year as policymakers explore digital asset integration into treasury systems and financial frameworks.

While federal regulatory debates continue around stablecoins and market structure, some states are testing narrower, asset-specific approaches.

Furthermore, Missouri’s proposal reflects a conservative implementation model.

By relying on donations and enforcing a minimum holding period, the bill positions Bitcoin as a long-term reserve asset, not a transactional instrument.

If passed, HB 2080 would signal growing political interest in treating Bitcoin as a strategic balance sheet asset at the state level.

However, the bill still faces committee review and potential amendments before any final vote.

For now, Missouri joins a small but expanding group of states formally debating Bitcoin’s role in public finance.

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

Rising U.S. Debt Fears Fuel XRP Bull Case – What’s Happening?

2CME Group Expands Into 24/7 Crypto Trading in Major Shift

3Ethereum Prepares Massive 2026 Network Overhaul – What’s Coming?

4Bitcoin Coiling Hard, Traders Brace For Move

5Solana Sentiment Implodes But Shorts May Regret It – Here’s Why

Latest

Also read

Similar stories you might like.