Stablecoin liquidity is the hidden engine of crypto markets.

Most discussions about crypto markets center on price. Traders monitor charts, headlines focus on volatility, and narratives rise and fall with daily price movements.

Yet price captures only the outcomes of trades, not the conditions that made those trades possible. Behind those visible swings, another force shapes how markets actually function. That force is stablecoin liquidity.

Stablecoin liquidity doesn’t announce itself. It doesn’t trend on social media, and it rarely becomes the focus of mainstream commentary unless something breaks.

However, it determines whether markets absorb large trades smoothly, whether volatility explodes during stress, and whether capital can move efficiently across the crypto ecosystem.

When liquidity flows freely, markets feel orderly and resilient. When it tightens, even small shocks ripple outward and amplify into larger dislocations.

This guide explains what stablecoin liquidity is, why it became essential to crypto markets, and how it quietly influences everything from execution quality to systemic stability.

Rather than treating stablecoins as simple digital dollars, we’ll examine them as infrastructure that underpins modern crypto markets.

In doing so, we’ll answer a broader question that price alone can’t answer: why liquidity, not price, often tells the real story of crypto market health.

What Stablecoin Liquidity Actually Means

To understand stablecoin liquidity, it is helpful to distinguish three concepts that are often conflated in market discussions: supply, circulation, and liquidity.

These terms appear similar yet describe very different realities.

Stablecoin supply refers to how many tokens exist in total. Circulation describes how many of those tokens sit in wallets, exchanges, or protocols at any given time.

Liquidity, by contrast, describes how easily those tokens can be deployed, exchanged, or absorbed without materially moving prices

A market can show massive supply and broad circulation while still suffering from poor liquidity.

In practice, liquidity depends on depth, accessibility, and behavior. A market with deep stablecoin liquidity allows large trades to execute with minimal slippage, tight spreads, and predictable outcomes.

A market with shallow liquidity may display impressive balances on dashboards while still struggling to handle meaningful volume without disruption.

Another critical distinction lies between on-chain and off-chain liquidity. On-chain liquidity lives inside smart contracts, pools, and decentralized protocols.

Off-chain liquidity sits within centralized exchanges, over-the-counter OTC desks, custodial platforms, and internal market-making systems.

Although both forms matter, they respond differently to volatility, counterparty risk, and operational stress.

Understanding this difference explains why a growing stablecoin market cap doesn’t always translate into healthier or more stable markets.

Liquidity requires not just tokens, but the willingness and capacity to deploy them under real conditions.

Why Stablecoins Became the Core Liquidity Layer of Crypto

Crypto markets didn’t start with stablecoins. Early trading centered on Bitcoin and, later, Ethereum as base currencies.

While this structure worked during the ecosystem’s infancy, it introduced serious limitations as markets expanded.

Volatility made crypto-native assets unreliable units of account, and constant price fluctuations distorted trading and risk management.

Stablecoins filled that gap by providing a dollar-referenced asset that remained native to crypto rails.

Traders could exit positions without leaving the ecosystem, exchanges could operate continuously without relying on slow banking infrastructure, and capital could move across venues without touching fiat systems.

Over time, stablecoins replaced fiat pairs as the dominant quote currency across spot, derivatives, and OTC markets.

This shift happened because stablecoins solved a coordination problem.

Traditional banking systems operate on limited schedules, rely on intermediaries, and fragment liquidity across jurisdictions.

Blockchains do not. By introducing a digital dollar that moved at blockchain speed, stablecoins aligned crypto markets around a shared liquidity layer that operated twenty-four hours a day.

As a result, stablecoins evolved beyond payments. They became market plumbing. Traders use them to park capital, rebalance exposure, and rotate risk.

Market makers rely on them to provide depth and continuity. Protocols depend on them to denominate loans, collateral, and leverage.

In effect, stablecoins became the connective tissue of crypto markets, enabling everything else to function.

How Stablecoin Liquidity Is Created and Destroyed

Stablecoin liquidity begins with issuance and redemption.

Issuers mint new tokens when authorized counterparties deposit fiat or equivalent collateral, and they destroy tokens when those counterparties redeem them.

This mechanism controls supply, but supply alone doesn’t guarantee liquidity.

Once minted, stablecoins flow into exchanges, market-making operations, decentralized protocols, and OTC desks.

Each step in that chain influences how accessible and responsive liquidity becomes.

Passively held tokens contribute little to market depth, whereas actively deployed tokens in trading and lending form the backbone of liquidity.

Liquidity expands when stablecoins move freely and participants feel confident deploying capital.

It contracts when redemptions accelerate, risk perception rises, or counterparties pull back. Importantly, contraction can occur even if total supply remains high.

Liquidity depends on behavior, not just balances.

This dynamic explains why markets sometimes feel illiquid despite an abundant stablecoin supply.

During periods of uncertainty, holders often prioritize safety over deployment, withdrawing liquidity from active use.

When confidence returns, the same supply can suddenly support far greater volumes, revealing how quickly liquidity conditions can change.

How Stablecoin Liquidity Moves Through Crypto Markets

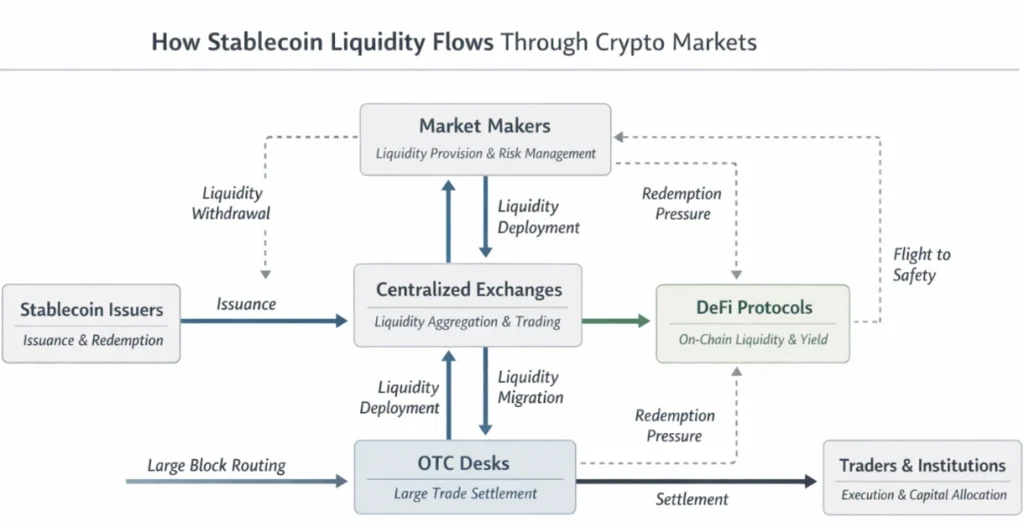

Stablecoin liquidity doesn’t remain fixed in one place. It circulates through several interconnected pathways, each serving a different role in the market.

Centralized exchanges act as aggregation hubs, concentrating liquidity and facilitating price discovery. DeFi protocols extend liquidity on-chain, enabling lending, swapping, and leveraged strategies.

OTC desks route liquidity privately, allowing large trades to settle without disrupting public order books. Cross-chain bridges move liquidity between ecosystems, often responding to yield opportunities or shifts in activity.

These pathways interact constantly. Liquidity may originate on an exchange, migrate into DeFi during periods of yield expansion, then return off-chain when volatility increases.

Because of this movement, stablecoin liquidity behaves more like a dynamic flow than a static reserve.

Understanding these flows matters because disruptions rarely stay isolated.

A bottleneck in redemptions, bridge failures, or exchange stress can ripple across the entire ecosystem, affecting liquidity availability everywhere at once.

Stablecoin Liquidity vs Price: Why They Aren’t the Same Thing

Price reflects the last trade. Liquidity reflects the market’s capacity to handle the next one. Confusing the two leads to misinterpretation.

Prices can rise sharply in low-liquidity environments because marginal demand pushes markets higher quickly. These moves often look bullish on the surface, yet they rest on fragile foundations.

Without depth, even small reversals can trigger outsized corrections.

By contrast, deep stablecoin liquidity often suppresses visible volatility. Large orders get absorbed quietly, spreads remain tight, and execution stays predictable.

To casual observers, markets may appear stagnant. Structurally, however, they’re healthier and more resilient.

This distinction matters when evaluating market conditions. Price tells you where markets moved. Liquidity tells you how durable those moves are under pressure.

The Role of Market Makers in Stablecoin Liquidity

Market makers operate at the intersection of liquidity and execution. They deploy stablecoins to provide continuous bid and ask liquidity, thereby smoothing price movements and narrowing spreads across markets.

However, market makers manage risk dynamically. When volatility spikes, correlations rise, or uncertainty increases, exposure declines.

Stablecoin balances may remain visible on exchanges, yet effective liquidity collapses as capital gets pulled back from active deployment.

This behavior reflects disciplined risk management rather than intent to destabilize markets. Market makers prioritize survival over constant presence.

As a result, stablecoin liquidity depends heavily on firms’ confidence, capital efficiency, and risk tolerance.

Understanding this relationship explains why liquidity often disappears fastest precisely when markets need it most.

Stablecoin Liquidity During Stress Events

Stress reveals structure. During market drawdowns, stablecoin liquidity often exhibits counterintuitive behavior.

In some cases, capital flees into stablecoins, expanding supply as participants exit volatile assets. In other cases, redemptions accelerate as holders seek fiat currency safety.

Liquidity fragments across venues as counterparty risk rises and trust erodes. Execution costs increase even when nominal supply appears stable.

These patterns show why liquidity metrics require careful interpretation. Supply growth during stress doesn’t guarantee deployable liquidity.

Often, it signals defensive positioning rather than readiness to take risk. True liquidity emerges only when capital moves willingly.

How Regulation Influences Stablecoin Liquidity

Regulation shapes liquidity indirectly by constraining issuers, intermediaries, and banking relationships.

Reserve requirements, redemption rules, and jurisdictional compliance all influence the ease with which stablecoins can be minted, redeemed, and moved.

When regulatory clarity improves, issuers gain confidence, expanding supply and supporting market activity.

When uncertainty rises, controls tighten, slowing issuance and increasing friction. These changes ripple through markets, affecting liquidity availability far beyond regulatory headlines.

As a result, policy debates around stablecoins directly influence market depth and stability, even when they appear abstract or technical.

What Stablecoin Liquidity Tells You About Market Health

Stablecoin liquidity provides insight into market capacity rather than direction. Rising issuance combined with active deployment often signals confidence.

Liquidity doesn’t predict price. Instead, it measures resilience. Healthy liquidity supports sustainable moves and orderly corrections. Fragile liquidity magnifies shocks and accelerates volatility.

Learning to read these signals helps market participants understand the environment in which they operate, rather than reacting solely to price action.

Where Stablecoin Liquidity Could Change Going Forward

Looking ahead, stablecoin liquidity faces structural pressures. Regulatory frameworks may reshape issuance.

Fragmentation across chains could complicate deployment. At the same time, institutional participation may deepen liquidity in select venues while leaving others thinner.

Despite these shifts, stablecoins will remain central. As long as crypto markets operate globally and continuously, they’ll rely on a native liquidity layer that behaves like cash while moving at blockchain speed.

Understanding Crypto Markets Through Stablecoin Liquidity

Stablecoin liquidity doesn’t capture headlines, yet it underpins everything crypto markets do. It enables trading, supports price discovery, and absorbs shocks.

When markets flow smoothly, they function. When it tightens, even small disruptions escalate into systemic stress.

By understanding how stablecoin liquidity works, market participants gain a clearer view of crypto’s internal mechanics.

Rather than focusing solely on where prices go, they begin to understand why markets behave as they do. That understanding matters far more than short-term narratives.

Frequently Asked Questions

Stablecoin liquidity refers to how easily stablecoins can be deployed, exchanged, or absorbed across crypto markets without significantly impacting prices.

Deep liquidity dampens volatility by absorbing large trades, while shallow liquidity amplifies price moves and increases execution costs.

USDT serves as a dominant trading pair across exchanges, making its liquidity central to price discovery and market depth.

In theory yes, but in practice stablecoins provide the speed, continuity, and capital efficiency that fiat rails can’t match.

No. Liquidity depends on willingness to deploy capital, not just the number of tokens in circulation.

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Also read

Similar stories you might like.