Harvard website magnified. Source: TechGaged / Shutterstock

Harvard Shifts Crypto Strategy, New Filing Reveals

In Brief

- • Harvard still holds ~$265M in Bitcoin ETF exposure.

- • Cut IBIT shares ~21% in Q4.

- • Added ~$86.8M in an Ethereum ETF, signaling diversification.

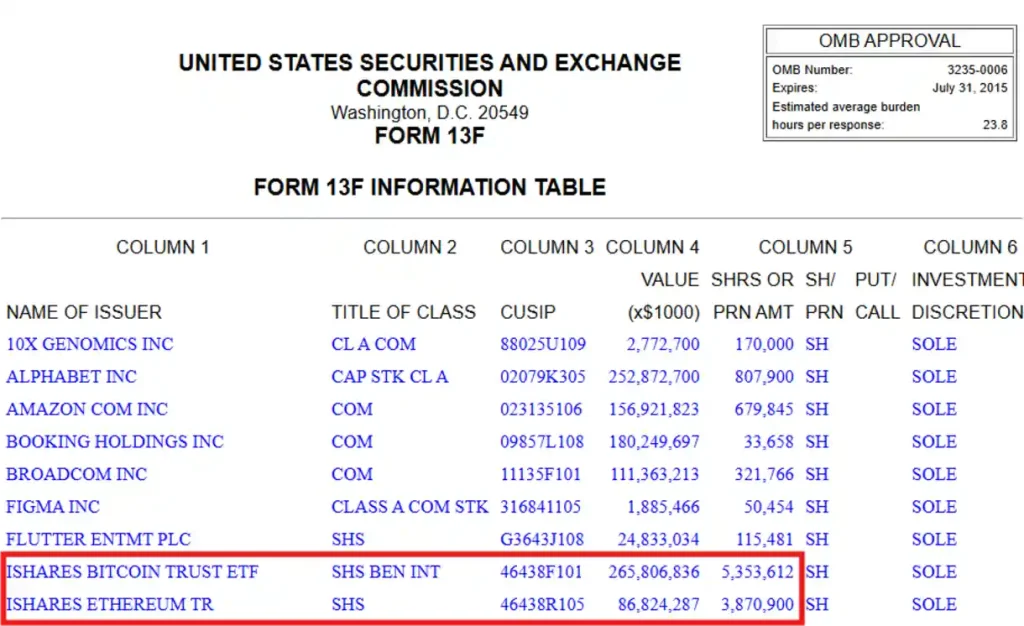

Harvard Management Co’s latest 13F filing shows Bitcoin (BTC) exposure still dominates its disclosed portfolio, with BlackRock’s IBIT ETF remaining its largest position at roughly $265.8 million. The filing also reveals a 21% reduction in IBIT shares during Q4 and a new $86.8 million allocation to the iShares Ethereum Trust (ETHA). The shift signals evolving institutional positioning between Bitcoin and Ethereum (ETH).

Bitcoin Still Top Disclosed Bet

Harvard Management Company has reaffirmed Bitcoin’s dominance in its public crypto exposure, according to its latest 13F dated December 31, 2025. The filing shows that BlackRock’s iShares Bitcoin Trust (IBIT) remains Harvard’s largest disclosed holding, valued at approximately $265.8 million.

Despite trimming its position during the quarter, Bitcoin continues to anchor the university’s visible cryptocurrency allocation.

Q4 Reduction In Bitcoin Exposure

The filing reveals that Harvard reduced its IBIT holdings by about 21% in Q4. Though the fund still maintains a sizable allocation, the reduction may reflect portfolio rebalancing rather than a directional shift away from Bitcoin.

Institutional investors often adjust exchange-traded fund (ETF) exposures near year-end for risk management, liquidity, valuation, and other reasons.

New Ethereum Position Emerges

In a notable development, the filing also shows Harvard initiated a new position in the iShares Ethereum Trust (ETHA), valued at around $86.8 million. This marks a meaningful step into Ethereum exposure within Harvard’s disclosed ETF portfolio.

The move aligns with a broader trend of institutions gradually diversifying beyond Bitcoin as regulated ETH investment vehicles gain traction.

What The Filing Suggests About Institutional Strategy

Taken together, the changes point to a more nuanced institutional approach, where Bitcoin remains the core institutional crypto asset, Ethereum is gaining relevance in diversified portfolios, and ETF-based exposure continues to dominate disclosure.

Rather than abandoning Bitcoin, Harvard appears to be expanding its crypto strategy to include multiple large-cap assets.

The Bigger Picture For Crypto Markets

13F filings offer a delayed but valuable window into institutional positioning, especially among large asset managers and endowments. Harvard’s continued Bitcoin leadership reinforces BTC’s role as the primary institutional entry point into crypto.

At the same time, the new Ethereum allocation reflects growing acceptance of ETH as a complementary macro asset, particularly as spot ETH ETFs mature.

What It Means For Investors

For market watchers, the filing underscores two key narratives heading into 2026: Bitcoin remains the dominant institutional benchmark, but Ethereum is increasingly entering the conversation as a secondary allocation.

If similar positioning trends appear across other 13F filings, it could signal a broader institutional rotation toward multi-asset crypto exposure.

Ethereum Price Today

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

Gravestone Doji: XRP Just Flashed a Brutal Historical Signal

2Crypto.com Becomes First Crypto Platform to Achieve This Certification

3Ethereum ICO Wallet Awakens After 10 Years – What Happened?

4SBI Holdings CEO Denies $10B XRP Holdings

5$2.3 Billion Vanished in Bitcoin Losses. History Says This Moment Matters

Latest

Also read

Similar stories you might like.