A Golden coin shines with symbols that represent Bitcoin and mining carved into its structure. It sits on top of multiple bitcoins

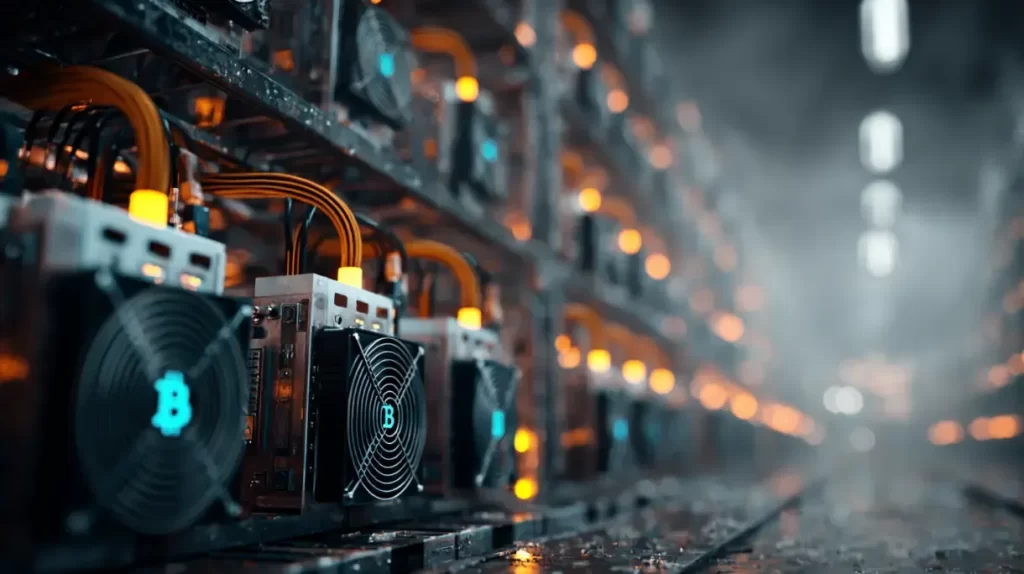

Large-scale miners are increasingly reallocating portions of their computing infrastructure toward high-performance AI and data-center workloads, where returns are currently more predictable than Bitcoin mining margins. While the move may appear alarming, the underlying driver is structural in nature.

Bitcoin’s network hashrate has fallen below 1 zettahash per second (ZH/s) for the first time in roughly four months, according to Hashrate Index network data.

This shift has been openly discussed in public earnings calls, investor presentations, and regulatory filings from several publicly listed mining companies over recent quarters.

Power Optimization Instead of Network Abandonment

Modern mining firms operate flexible infrastructure capable of switching between proof-of-work hashing and AI compute leasing. Moreover, as demand for AI training capacity continues to surge, miners are allocating energy to higher-margin uses during periods of compressed mining profitability.

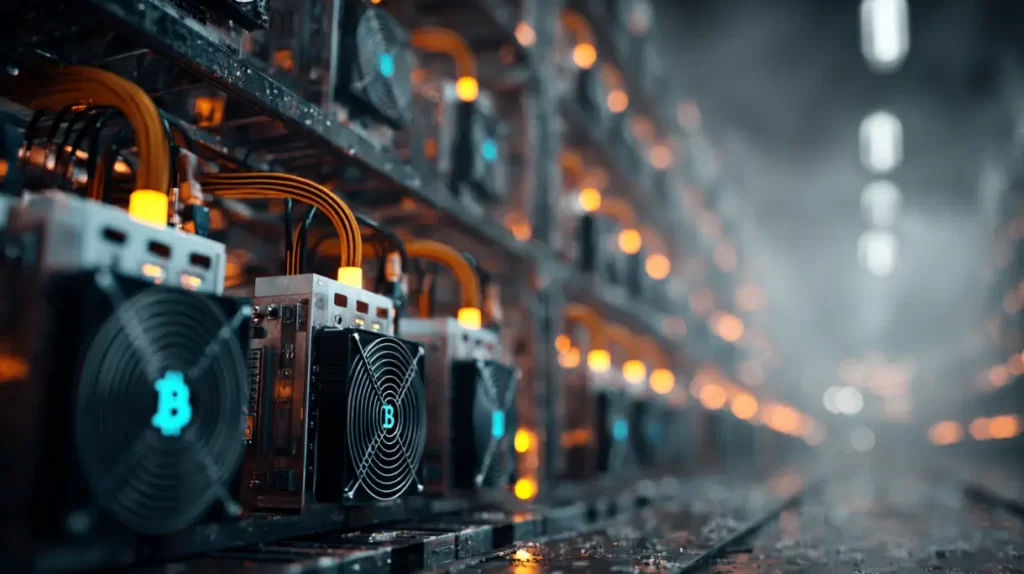

It’s worth noting that this has not triggered any noticeable disruption to Bitcoin’s block production. Additionally, the protocol’s difficulty adjustment mechanism remains fully functional, ensuring network stability even as hashrate fluctuates.

In simpler terms, the dip reflects miners optimizing capital efficiency rather than leaving the Bitcoin ecosystem.

What This Means for Bitcoin’s Price

The hashrate decline itself hasn’t produced immediate bearish price pressure, suggesting the market views the shift as an operational development more than an existential threat.

Technically, Bitcoin continues to hold above its major higher-timeframe support zone near $90,000. Also, with resistance established between $97,000 and $100,000.

Until those levels are decisively reclaimed, price action is likely to remain choppy as leverage resets and spot demand reasserts itself. However, on the fundamental side, a lower hashrate during periods of miner optimization can actually reduce structural sell pressure.

Indeed, when miners earn revenue through AI compute contracts rather than block rewards alone, they are less reliant on selling BTC into the market to cover operating costs.

Looking ahead, the intersection of Bitcoin mining and AI infrastructure is becoming a defining theme for the industry. Keep in mind that as energy-efficient data centers serve dual purposes, mining firms gain resilience across market cycles.

This evolution could add strength to Bitcoin’s security model by ensuring miners remain profitable, capitalized, and operationally flexible.

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

Peter Schiff Warns of a U.S. Dollar Collapse Far Worse Than 2008

2Dubai Insurance Launches Crypto Wallet for Premium Payments & Claims

3XRP Whales Buy The Dip While Price Goes Nowhere

4Samsung crushes Apple with over 700 million more smartphones shipped in a decade

5Luxury Meets Hash Power: This $40K Watch Actually Mines Bitcoin

Latest

Also read

Similar stories you might like.