Bitcoin in front of Google logo. Source: TechGaged / Shutterstock

‘Bitcoin Going to Zero’ Searches Hit 5-Year High as Market Braces for Shift

In Brief

- • “Bitcoin going to zero” searches hit 5-year high.

- • Spike reflects rising retail fear and volatility.

- • Extreme fear historically aligns with accumulation phases.

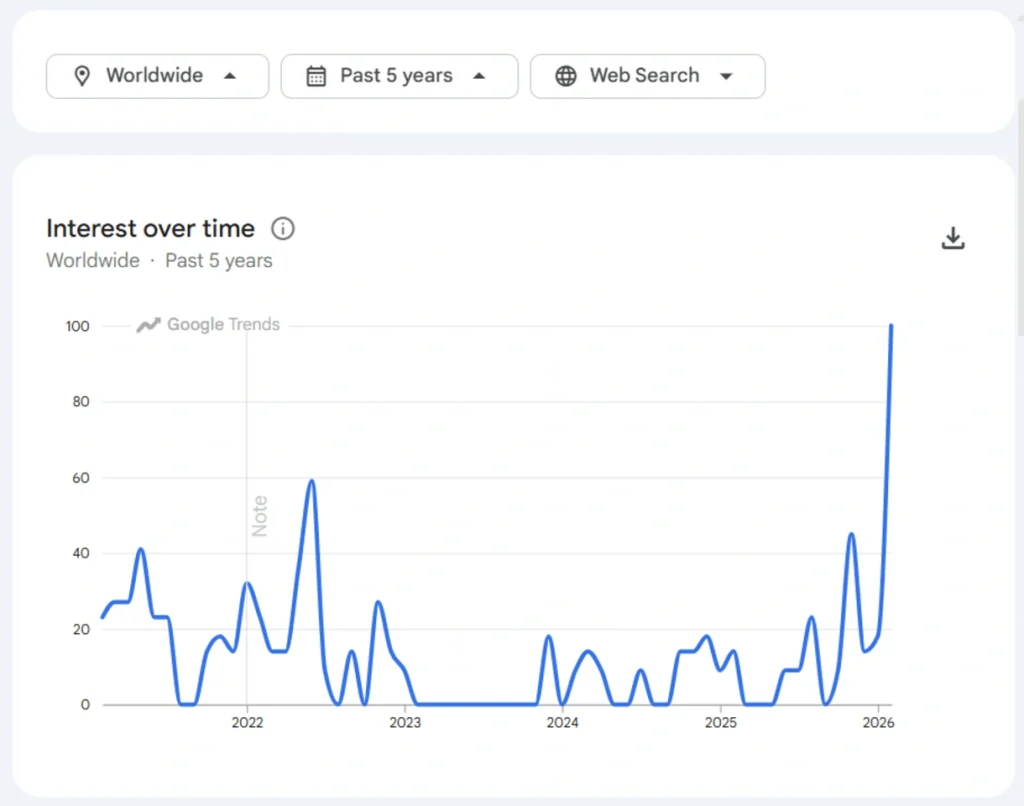

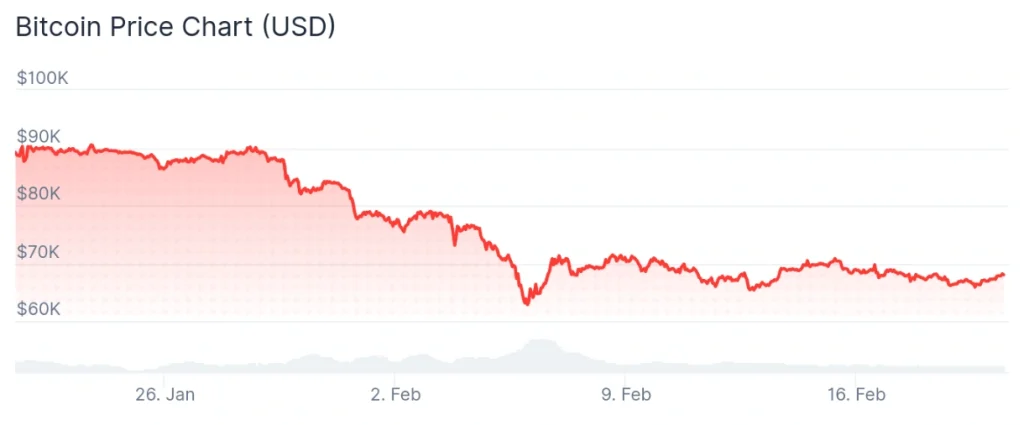

Searches for “Bitcoin going to zero” just hit a five-year high on Google Trends. The spike showed up in early 2026, matching a stretch of choppy price action and rising volatility. The jump matters because retail search behavior often tracks fear, and fear tends to shape short-term market moves.

Bitcoin Gloom and Doom Narrative Returns

Google Trends shows a sharp rise in global interest for the phrase, with levels last seen during prior stress periods. The data measures search frequency relative to overall volume, so a surge points to a sudden shift in attention, not just background noise.

This kind of spike usually shows up when markets get shaky. Past bear phases and major drawdowns produced similar waves of chatter heralding Bitcoin’s death. It rarely starts with price alone. Social feeds, headlines, and group sentiment push the narrative faster than charts do.

Notably, search spikes do not always line up with exact bottoms. They tend to reflect anxiety among newer participants who react after volatility is already visible.

Bitcoin is currently trading at the price of $68,038.26, up 1.9% on the day, gaining 1.7% across the week, and accumulating a decline of 23.7% over the past month, according to the most recent chart information.

Fear Cycles Are Part of Bitcoin’s History

Bitcoin has been written off countless times, then clawed its way back. Each cycle brings a fresh round of skepticism, often louder than the last because the audience is bigger.

Extreme fear has often marked accumulation phases in the cryptocurrency market. When pessimism peaks, long-term holders tend to step in quietly while retail sentiment turns defensive.

This time, though, the backdrop is different. The market is more institutional than in past cycles. Exchange-traded funds (ETFs) and corporate exposure, with tighter global liquidity thrown into the mix, all shape how sentiment flows through the system.

Is Sentiment Near Another Turning Point?

A sudden surge in doom-related searches can signal an emotional pivot. Retail sentiment usually trails price, so search data often confirms fear after volatility starts.

What happens next is relatively unclear. A deeper correction may ensue, or simply another familiar sentiment loop, but Bitcoin has a long track record of moving through waves of panic, then resetting expectations.

One pattern keeps repeating. Every time the “Bitcoin going to zero” narrative comes back, the same question pops up again: Is fear a warning sign, or an entry signal for those willing to lean the other way?

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

Rising U.S. Debt Fears Fuel XRP Bull Case – What’s Happening?

2CME Group Expands Into 24/7 Crypto Trading in Major Shift

3Bitcoin Coiling Hard, Traders Brace For Move

4Solana Sentiment Implodes But Shorts May Regret It – Here’s Why

5Ethereum Prepares Massive 2026 Network Overhaul – What’s Coming?

Latest

Also read

Similar stories you might like.