Bitcoin price drop. Source: TechGaged / Shutterstock

Bitcoin Bear Cycle Warning – Here’s What It Means

In Brief

- • Analyst warns rising volatility may signal early bear cycle.

- • Liquidity trends remain the key confirmation factor.

- • Bitcoin may be moving from early to broader downturn phase.

Bitcoin (BTC)’s current market structure may be more fragile than many investors believe. A recent analysis shows that volatility, a metric closely tracked by quantitative traders, suggests Bitcoin could still be early in a broader bear cycle. Though price action remains relatively stable compared to past downturns, underlying signals tell a different story.

Volatility Signals Bear Market Pressure

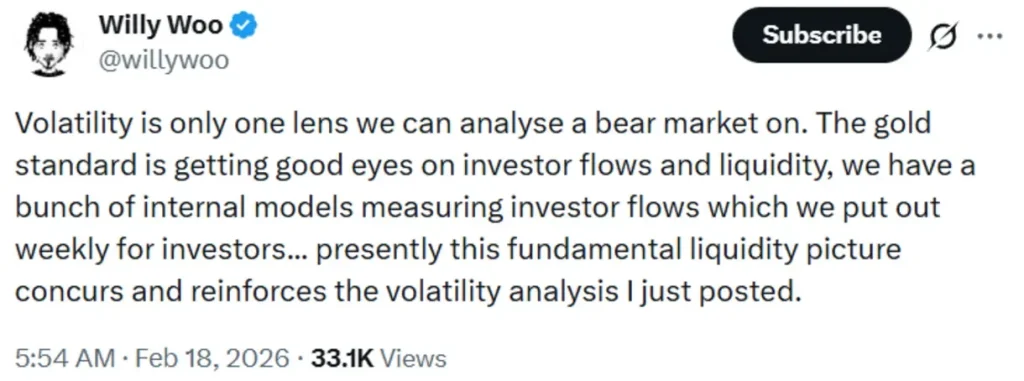

Indeed, according to an analysis shared by popular cryptocurrency industry expert Willy Woo on February 18, rising volatility has historically marked the beginning of Bitcoin bear markets.

When volatility spikes sharply and continues climbing, it often reflects growing uncertainty, capital outflows, and weakening liquidity, which are all the key ingredients for a prolonged downturn.

In previous cycles, volatility typically peaks mid-to-late bear market, followed by smaller spikes near macro bottoms that signal capitulation. This framework places volatility as an early warning indicator rather than a lagging signal.

Liquidity Still The “Gold Standard”

Despite highlighting volatility, Woo stressed that liquidity remains the most reliable macro signal. He noted that internal models tracking capital flows and investor behavior currently support the bearish volatility read.

If liquidity continues weakening, price trends may follow, especially in an asset as liquidity-sensitive as Bitcoin. Because Bitcoin is relatively small compared to global markets, it tends to react faster when capital shifts. This is why BTC often leads broader macro risk cycles by months.

A Three-Phase Bitcoin Bear Model

Next, Woo outlined a three-stage framework for understanding Bitcoin bear markets.

In Phase 1, liquidity breaks down, and price begins trending lower.

This stage is often dismissed by bulls as a correction. Phase 2 is where broader markets turn bearish. Global equities weaken, confirming a full risk-off environment.

Finally, in the last stage, Phase 3, capital outflows stabilize, and investors return. This phase usually includes final capitulation before recovery.

“The light at the end of the tunnel. In this phase, we see liquidity starting to turn around, the outflow of capital peaks and starts to stabilise. Investors are returning. A final price capitulation is usually found in this phase, either before or slightly after the peak outflows.”

Under this model, Woo believes Bitcoin may currently be transitioning from Phase 1 toward Phase 2.

Meanwhile, the flagship asset of the crypto market is trading at the price of $67,466.03, indicating a 0.4% decline on the day, advancing 0.6% across the week, and accumulating a drop of 27.4% over the past month, according to the most recent chart data.

Why This Matters For Investors

If the framework proves accurate, it suggests Bitcoin’s next major move may depend more on macro liquidity than short-term narratives. That could mean slower recoveries after rallies, higher sensitivity to global markets, and increased volatility before a true bottom forms.

However, Woo also emphasized that volatility is just one lens among many. Bear market timing remains complex, and multiple indicators are needed for confirmation.

Bitcoin Price Today

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Also read

Similar stories you might like.