Coinbase Introduces a Wallet Built for Machines, Not Humans

In Brief

- • AI agents can now hold and move crypto independently using Coinbase’s new wallet infrastructure.

- • Agentic Wallets introduce programmable, policy-driven transactions designed for machine execution.

- • The launch signals a broader shift toward blockchain as the financial layer for autonomous AI systems.

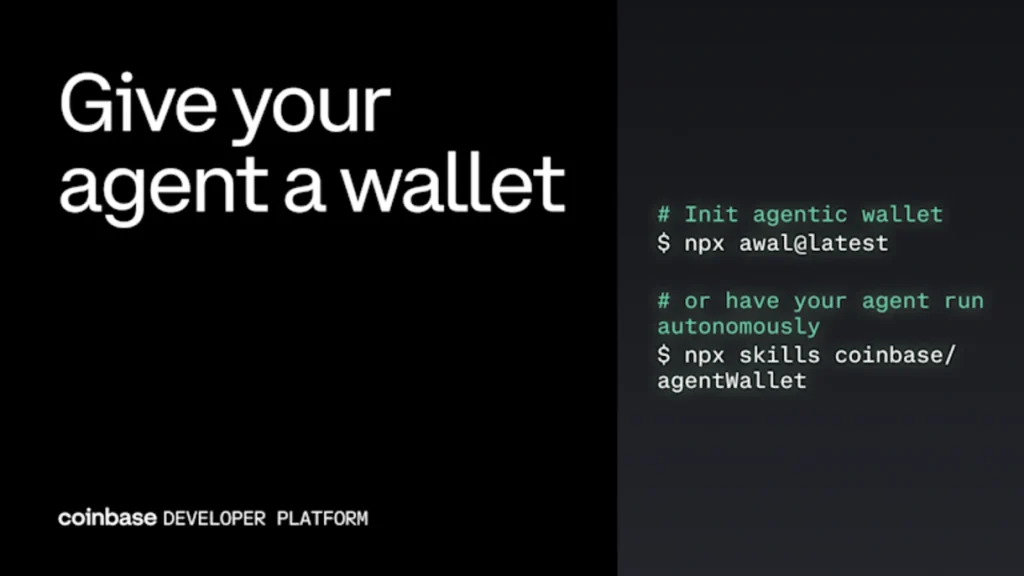

Coinbase has launched Agentic Wallets, a new wallet framework designed specifically for autonomous AI agents. The system allows software to directly control funds, maintain identity, and execute on-chain transactions without manual authorization.

The next evolution of crypto infrastructure may not be designed for traders or investors at all. Instead, it may be built for software.

Indeed, these wallets allow software to directly control funds, maintain identity, and execute transactions onchain without manual authorization.

How Agentic Wallets Work

Artificial intelligence systems require native financial rails. Therefore, if AI is to operate independently to access data, settle services, or coordinate digital workflows, it must be able to transact without relying on traditional banking infrastructure designed around human verification cycles.

Moreover, Coinbase’s model gives developers the ability to embed programmable controls, permissions, and execution logic directly into the wallet layer.

As a result, this would allow AI agents to operate within defined constraints while still maintaining non-custodial ownership.

According to Coinbase’s documentation, Agentic Wallets are purpose-built to give AI agents the same functional capabilities as human-controlled wallets.

Unlike traditional wallets, which assume a person signs every action, this infrastructure enables policy-driven execution.

Meaning that developers can define programmable spending rules, permissions, and operational boundaries so agents can transact autonomously while remaining constrained by predefined logic.

Additionally, the model blends self-custody principles with automation, meaning control is still cryptographic and not custodial.

Crypto and AI Share the Same Economic Layer

The introduction of Agentic Wallets is less about wallets themselves and more about positioning blockchain as the settlement backbone for machine-driven economies.

AI systems are moving toward autonomous operation. However, until now, they lacked a native way to hold value or participate in transactions without intermediaries.

Moreover, traditional payment systems introduce latency, jurisdictional friction, and identity requirements. These systems don’t translate well to machine-to-machine interaction.

On the other hand, blockchain infrastructure allows straight execution, programmable ownership, and continuous availability.

Therefore, the industry is currently experimenting with frameworks where AI agents can negotiate, transact, and verify outcomes directly onchain.

Coinbase’s release suggests the convergence of crypto and AI is now shifting from narrative to infrastructure.

Instead of asking whether blockchain and AI can intersect, companies are now building the roots that make autonomous economic participation possible.

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

Bitcoin Would Need to Reach $1.7M per BTC to Match Gold’s Market Cap

2White House Urges Stablecoin Deal, Sets the Deadline as Debate Continues

3Ethereum Whales Cut Holdings as Retail Share Hits Record, Signaling Market Shift

4Turning Point: Bitcoin Drops Into Rare Oversold Territory Last Seen During the COVID Crash

5Goldman Sachs Boosts XRP Exposure As Retail Hesitates

Latest

Also read

Similar stories you might like.