OTC trading is where the real size moves, the hidden market

Most people imagine Bitcoin trading as something that happens on exchanges, in full view of the market, where every buy or sell immediately shows up on a chart.

That picture feels intuitive because price charts dominate how crypto markets are discussed. Yet once trade sizes grow beyond a certain threshold, that intuition breaks down.

Large Bitcoin transactions rarely behave the way retail traders expect. They don’t always cause sudden spikes or crashes. They often don’t appear on order books at all.

In many cases, they don’t move price immediately, even when hundreds of millions of dollars change hands.

This disconnect between size and visibility leads to confusion, speculation, and persistent myths about “hidden whales” and market manipulation.

The missing piece is OTC crypto trading. Over-the-counter trading exists precisely because public exchanges aren’t designed to handle large block trades efficiently.

OTC desks provide a parallel market structure that allows institutions, funds, miners, and high-net-worth participants to transact size without destabilizing prices or revealing intent.

This guide explains what OTC crypto trading actually is, why it exists alongside exchanges, and how large Bitcoin deals quietly influence market behavior.

Instead of focusing on secrecy or drama, we’ll focus on mechanics. Understanding those mechanics reveals how price discovery really works at scale.

What OTC Crypto Trading Actually Is

OTC crypto trading refers to bilateral or intermediary-facilitated transactions that occur outside public exchange order books.

Rather than placing orders into an open market, participants negotiate trades directly, usually through an OTC desk that acts as broker, principal, or liquidity intermediary.

The defining feature of OTC trading isn’t privacy for its own sake. It’s control.

OTC trades allow participants to manage execution, pricing, timing, and settlement in ways that public exchanges can’t support at scale.

This matters most when trade size threatens to overwhelm visible liquidity.

Unlike exchange trading, OTC transactions don’t rely on matching thousands of small orders.

Instead, they aggregate liquidity internally, source counterparties discreetly, and settle trades according to predefined terms. The price may reference public markets, but execution happens off-exchange

This structure explains why OTC trading coexists with exchanges rather than replacing them. Exchanges handle continuous price discovery and retail flow.

OTC desks handle size, discretion, and execution certainty.

Why Exchanges Aren’t Built for Large Bitcoin Trades

Public exchanges excel at transparency and accessibility. They perform poorly when confronted with concentrated demand or supply.

Order books may appear deep at first glance, yet visible depth often collapses once size enters the market.

The core issue is signaling. When a large order enters an exchange, it broadcasts intent. Other participants respond by adjusting orders, widening spreads, or pulling liquidity.

This reaction amplifies slippage and pushes prices away from the original quote before execution completes.

Even when liquidity looks sufficient, execution quality degrades quickly as order size increases. Fragmentation across exchanges further complicates matters.

Splitting orders across venues reduces impact but introduces latency and coordination risk.

OTC trading solves these problems by removing signaling. Trades occur without advertising size or direction, allowing markets to remain orderly while large transactions settle in parallel.

How OTC Crypto Trading Works Step by Step

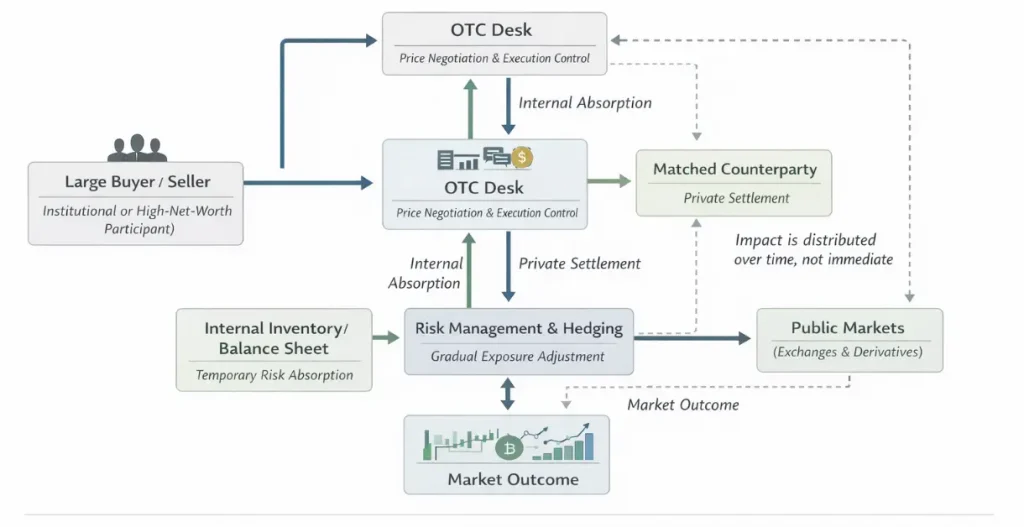

An OTC trade begins with intent rather than execution. A participant approaches a desk with a desired trade size, asset, and timing window.

The desk assesses market conditions, internal inventory, and counterparty availability.

Pricing follows. OTC quotes typically reference spot markets but include adjustments for size, liquidity conditions, and risk. Unlike exchange orders, OTC prices are negotiated, not discovered through matching engines.

Once terms are agreed, settlement begins. Depending on structure, the desk may act as principal, taking the trade onto its own balance sheet, or as broker, matching counterparties directly.

Settlement may occur immediately or over a defined period to manage risk.

Throughout this process, discretion remains central. Execution minimizes market impact, even though the trade’s economic weight eventually influences supply and demand elsewhere.

How Large Bitcoin Deals Really Move the Market

A common misconception holds that OTC trades don’t affect price because they happen “off-market.” In reality, OTC activity influences markets indirectly and often with a delay.

When desks internalize trades, they assume inventory risk. That risk doesn’t disappear. It gets managed.

Desks hedge exposure through public markets, derivatives, or future rebalancing. These hedging flows influence liquidity and price over time.

Timing matters. OTC trades may settle quietly during low-volatility periods, with impact distributed gradually rather than concentrated in a single moment.

This diffusion makes cause-and-effect harder to spot but no less real.

As a result, OTC trading changes how markets move, not whether they move. Price reacts to positioning and liquidity adjustments, not the initial handshake.

OTC Trading vs Exchange Trading: The Real Differences

The difference between OTC and exchange trading isn’t secrecy versus openness. It’s execution certainty versus continuous discovery.

Exchange trading prioritizes immediacy and transparency.

OTC trading prioritizes predictability and control. Exchanges expose traders to slippage and signaling risk. OTC desks absorb those risks in exchange for spreads and fees.

Neither model is superior in isolation. Each serves different needs. Retail traders benefit from exchanges. Institutions depend on OTC desks to transact size responsibly.

Understanding this distinction helps explain why both structures coexist and why large Bitcoin trades rarely behave like scaled-up retail orders.

The Role of Market Makers and Liquidity Providers

Market makers play a critical role in OTC ecosystems. They provide balance sheet capacity, manage inventory, and smooth execution across time.

When a desk quotes a large trade, it often relies on internal market makers to hedge or warehouse risk.

These market makers decide how and when to offset exposure, shaping downstream liquidity conditions.

During calm markets, this process feels seamless. During stress, it becomes fragile.

If market makers reduce risk tolerance, OTC liquidity tightens, spreads widen, and execution becomes harder.

This dependence explains why OTC markets can freeze during extreme volatility, even when public exchanges remain active.

OTC Crypto Trading During Market Stress

Stress exposes the limits of discretion. During sharp drawdowns or sudden rallies, OTC demand often increases as participants seek controlled execution.

At the same time, liquidity providers grow cautious. Counterparty risk rises. Pricing becomes harder. Desks shorten quotes or pause activity altogether.

This dynamic creates a paradox. OTC trading becomes more desirable precisely when it’s least available. Understanding this constraint helps explain why large moves often accelerate once OTC liquidity retreats

Regulation, Compliance, and OTC Crypto Trading

OTC trading operates under stricter compliance frameworks than many assume. KYC, AML, and jurisdictional rules shape who can access desks and under what terms.

Regulation affects liquidity indirectly by limiting counterparties, increasing operational costs, and shaping where desks operate. These constraints influence spreads and availability.

Rather than eliminating OTC trading, regulation channels it. Well-capitalized desks adapt. Marginal participants disappear. The result is consolidation rather than extinction.

What OTC Activity Signals About Market Conditions

OTC volume offers insight into market structure, not sentiment. Rising OTC activity often reflects institutional repositioning rather than bullish or bearish conviction.

However, opacity limits interpretation. OTC data rarely appears in real time, and reported figures lag actual flows. As a result, OTC activity should be read cautiously and contextually.

It signals where liquidity prefers to operate, not where price will go next.

Where OTC Crypto Trading Is Headed

As institutional participation grows, OTC trading will remain central to Bitcoin markets. Integration with exchanges may deepen, yet discretion will remain essential.

Technology may improve settlement and reporting, but structural constraints will persist. Large trades will always require controlled execution.

OTC trading exists because market structure demands it, not because participants want secrecy.

Looking ahead, OTC activity will likely become less mysterious but no less important. Greater transparency around aggregate flows may emerge, yet execution itself will remain discreet by necessity.

However, what will change is not the role OTC trading plays, but how well market participants understand it.

As that understanding improves, narratives around hidden whales may fade. Replaced by a clearer view of how liquidity, risk, and execution quietly shape Bitcoin markets beneath the surface.

Understanding OTC Trading Beyond the Headlines

OTC crypto trading explains why large Bitcoin deals don’t behave like scaled-up retail trades. It reveals how liquidity, discretion, and execution shape markets behind the scenes.

Rather than focusing on hidden actors or manipulation narratives, understanding OTC mechanics provides clarity.

Markets move not because of where trades happen, but because of how risk and liquidity adjust over time. Therefore, large transactions don’t express themselves through sudden price spikes or dramatic candles, but through gradual shifts in liquidity, positioning, and execution behavior.

When OTC activity increases, it often signals that meaningful capital is being repositioned, even if charts remain quiet.

Additionally, the absence of visible movement doesn’t imply inactivity. Instead, it reflects a different layer of the market doing its work out of sight.

Understanding this distinction helps separate noise from structure. Price captures outcomes, while OTC trading reflects process.

That perspective doesn’t offer predictions, but it does offer a clearer framework for interpreting how the market functions beyond the surface.

Seeing OTC trading clearly means seeing Bitcoin markets as they really are.

Frequently Asked Questions:

OTC crypto trading allows large buyers and sellers to transact directly or through desks without using public exchange order books.

Because exchanges can’t absorb large orders without significant slippage or signaling risk.

Yes, indirectly. OTC trades influence liquidity and hedging flows that affect price over time.

Yes, when conducted through compliant desks that follow jurisdictional regulations.

OTC trading prioritizes execution certainty and discretion, while exchanges prioritize transparency and continuous price discovery.

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

Crypto Market Correction Erased 11,849 Bitcoin Millionaires Within Weeks

2Crypto Firms Are Offering Banks a Deal to Save a Key US Bill

3Bitcoin Drop Isn’t Retail Panic, Says Veteran Trader

4Ethereum Founder Keeps Selling ETH – Here’s Why

5Crypto Volatility Exceeds Great Depression Extremes, Bloomberg Analyst Warns

Latest

Also read

Similar stories you might like.