If this trend holds, Ethereum’s lending dominance could continue to act as a stabilizing force for the wider DeFi market.

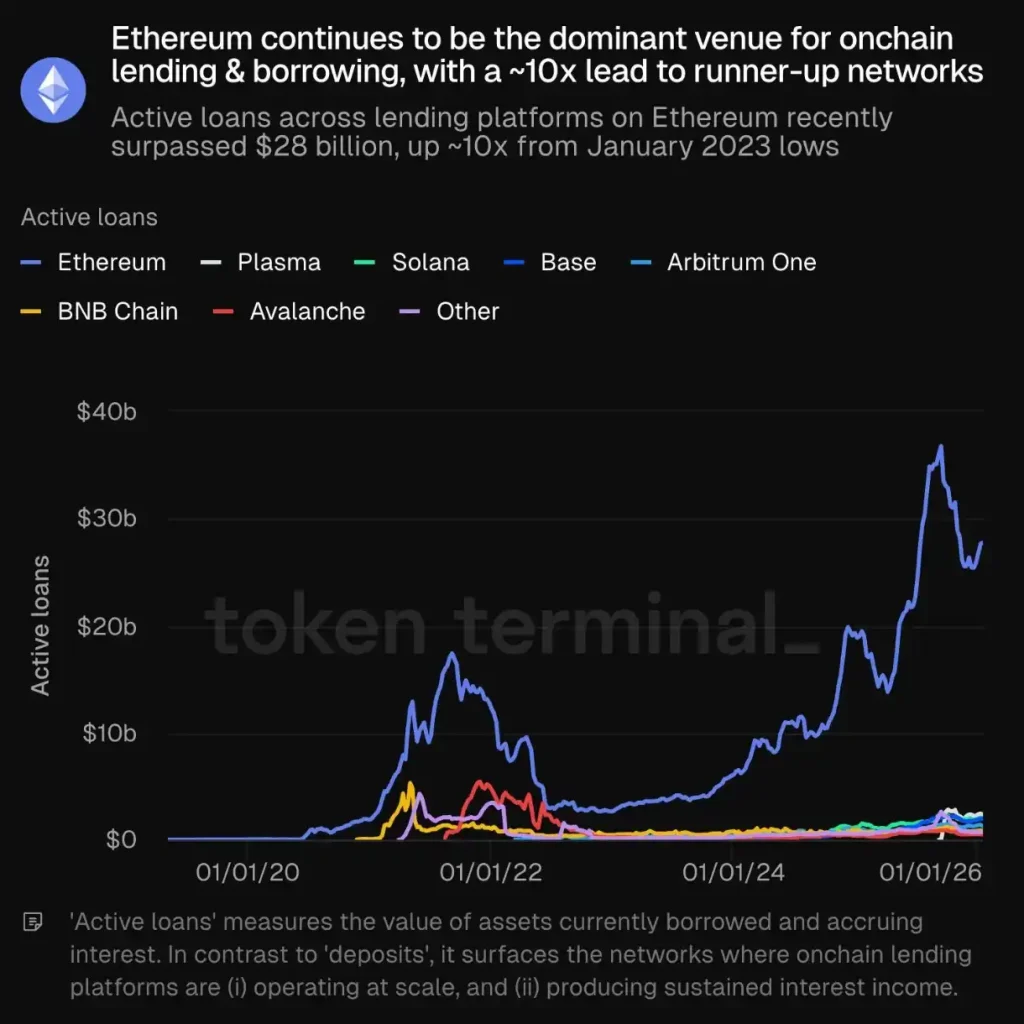

Ethereum Active Loans Jump 10x, Signaling Rising On-Chain Demand

In Brief

- • Ethereum’s active on-chain loans have surged past $25 billion.

- • The network remains the dominant hub for DeFi lending.

- • Rising loans signal renewed real usage, not just parked capital.

While attention often shifts to newer chains, Ethereum (ETH) continues to anchor the largest share of on-chain lending, with fresh data showing active loans on Ethereum climbed past $28 billion.

This reinforces its role as the primary venue for cryptocurrency borrowing and interest generation, leaving traders to wonder whether decentralized finance (DeFi) might be consolidating around scale rather than speed.

What The Data Shows

According to data sourced from Token Terminal on February 4, Ethereum’s active loans across lending protocols surpassed $28 billion, marking roughly a 10x increase from the lows seen in early 2023, before slowing down to the current $25 billion.

“Active loans” track the value of assets currently borrowed and accruing interest, offering a clearer picture of where lending activity is actually happening, not just where capital is parked. By that measure, Ethereum remains far ahead of competing networks.

The chart shows a familiar pattern of Ethereum lending activity surging during previous market cycles, cooling during the 2022-2023 downturn, and steadily rebuilding since. Other blockchains, including Solana (SOL), Base (BASE), and Arbitrum One (ARB), have grown, but at a much smaller scale.

Why Ethereum Keeps The Lending Crown

Scale and reliability matter in lending markets. Deep liquidity, established protocols, and consistent borrower demand tend to cluster where risk is best understood. Ethereum’s long-running DeFi infrastructure continues to provide that environment.

The roughly tenfold rebound since 2023 also suggests that borrowing demand has returned alongside broader market recovery. That matters because lending activity reflects real usage, traders, funds, and protocols putting capital to work rather than passively holding assets.

Rival chains are not standing still. Faster settlement and lower fees are drawing experimentation elsewhere. But for now, the data shows Ethereum remains the place where on-chain lending operates at sustained, meaningful scale.

If this trend holds, Ethereum’s lending dominance could continue to act as a stabilizing force for the wider DeFi market, even as competition intensifies at the margins.

Ethereum Price Today

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Also read

Similar stories you might like.