Crypto cycles aren’t just price swings, they’re shifts in liquidity, behavior, and market structure.

Crypto Market Cycles: What Actually Changes Between Each Phase

In Brief

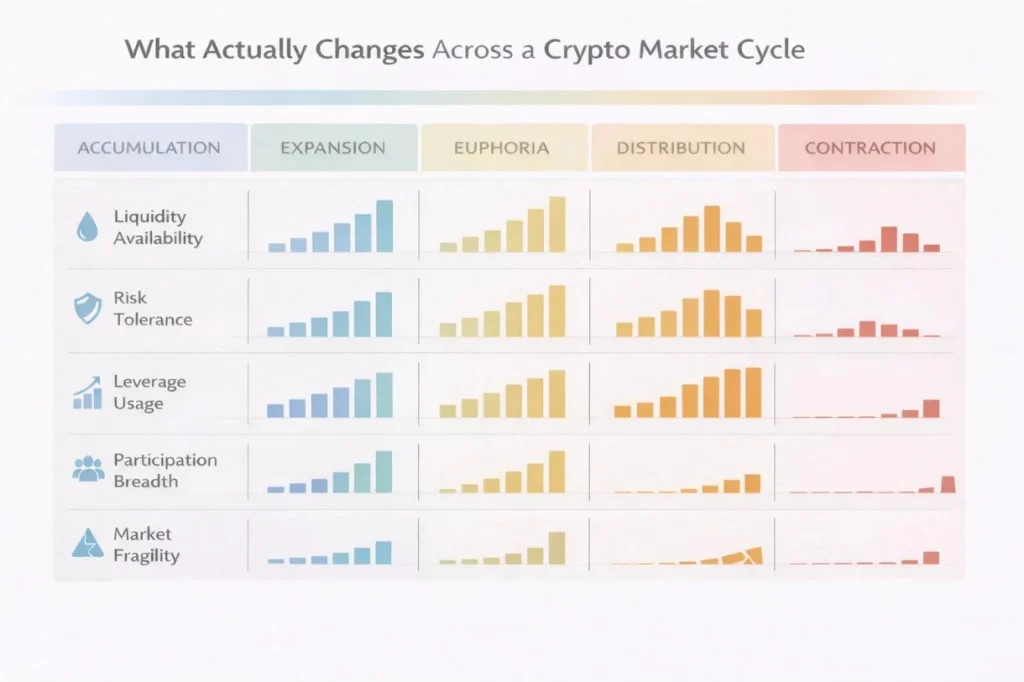

- • Crypto market cycles are driven by changes in liquidity, risk tolerance, and participation, not by price movements alone.

- • Each phase of a crypto market cycle has distinct structural behavior that shapes volatility and market reactions.

- • Markets turn when structure breaks or repairs, often before narratives or prices make it obvious.

Crypto market cycles often get reduced to a simple story. Prices go up, excitement builds, prices crash, despair follows, and then everything repeats. That narrative feels intuitive because charts make it visible. Yet focusing on price alone misses what truly defines each phase of a crypto market cycle.

Markets don’t shift phases because prices cross arbitrary levels. They change because liquidity, risk appetite, participation, and market structure evolve beneath the surface.

Price responds to those changes, but it doesn’t cause them. When people mistake price for structure, they misunderstand where the market actually is and why it behaves the way it does.

In crypto, this misunderstanding is amplified by volatility and speed. Cycles compress, narratives rotate quickly, and new participants enter without historical context.

As a result, many assume every rally marks a new bull market, and every drawdown signals the end. In reality, each phase of a crypto market cycle has distinct characteristics that go far beyond charts.

This guide explains what crypto market cycles really are, what actually changes between each phase, and why understanding those changes matters more than trying to time tops or bottoms.

Crypto Market Cycles Explained

A crypto market cycle represents a recurring sequence of structural conditions that shape how capital enters, moves through, and exits the market.

Price trends reveal cycles, but behavior, liquidity, and risk tolerance ultimately define them.

Each phase reflects a different balance between speculation and caution. During some phases, participants willingly deploy capital and absorb risk.

During others, they protect capital and avoid exposure. These shifts alter how markets respond to information, how liquidity behaves, and how volatility expresses itself.

Crypto market cycles also differ from traditional market cycles in duration and intensity. Continuous trading, high leverage, and fragmented liquidity accelerate transitions.

Yet despite these differences, the underlying mechanics remain consistent. Capital moves in stages, confidence rises and falls, and the market continually reprices risk over time.

Capital still flows in stages, confidence still rises and falls, and risk still gets repriced over time.

Understanding cycles means recognizing that markets move through conditions, not moods.

Why Crypto Market Cycles Exist at All

Crypto market cycles exist because markets are human systems layered on top of technical infrastructure. Participants react to opportunity, fear, and uncertainty in predictable ways, even when technology evolves.

Early in a cycle, capital enters cautiously. Liquidity improves slowly. As confidence builds, participation expands, and risk tolerance increases. Eventually, excess builds.

Leverage rises, pricing disconnects from fundamentals, and liquidity becomes fragile. When conditions reverse, the process unwinds.

In crypto, this dynamic is intensified by narratives and innovation. New technologies, protocols, and use cases attract capital quickly, often faster than markets can absorb responsibly.

That acceleration doesn’t eliminate cycles. It compresses them.

As long as crypto markets involve speculative capital, asymmetric information, and evolving infrastructure, cycles will persist.

The Accumulation Phase: When Structure Starts to Heal

Accumulation begins after a period of contraction. Prices stabilize, volatility declines, and selling pressure weakens. This phase often feels uneventful because excitement has faded and narratives have collapsed.

What actually changes during accumulation is liquidity behavior. Forced sellers exit. Long-term participants begin deploying capital quietly. Market makers return cautiously, improving depth without aggressively tightening spreads.

Participation remains limited. Media attention stays low. Price movement looks dull. Yet structurally, the market is repairing itself.

Risk resets, leverage declines, and capital slowly re-enters under controlled conditions.

Accumulation isn’t about optimism. It’s about exhaustion giving way to balance.

The Expansion Phase: Liquidity and Participation Return

Expansion begins when liquidity improves enough to support sustained movement. Capital flows accelerate, participation broadens, and prices begin trending rather than ranging.

What changes most during expansion isn’t price direction, but responsiveness. Markets absorb trades more easily. Pullbacks find buyers quickly. Volatility increases, yet it remains orderly.

This phase attracts new participants. Narratives regain traction. Builders, investors, and traders re-engage. Importantly, leverage begins to rise again, though it remains manageable early on.

Expansion feels constructive because market structure supports risk-taking without immediate punishment.

The Euphoria Phase: When Risk Tolerance Peaks

Euphoria marks the point where confidence turns into excess. Participation becomes widespread, leverage expands aggressively, and narratives overshadow fundamentals.

What changes during this phase is risk perception. Participants assume liquidity will always be available.

Market makers quote tighter spreads, yet depth becomes fragile beneath the surface. Small shocks begin causing disproportionate reactions.

Price moves dominate attention, but structural warning signs appear. Funding rates stay elevated. Volatility spikes without clear catalysts. Execution quality deteriorates during stress.

Euphoria doesn’t end because optimism disappears. It ends because the system becomes too fragile to sustain itself.

The Distribution Phase: Liquidity Starts to Withdraw

Distribution occurs when informed participants reduce exposure while broader participation remains enthusiastic. Prices may continue rising or move sideways, masking underlying shifts.

What actually changes here is liquidity deployment. Market makers manage risk more defensively. Large holders sell into strength, often through OTC channels. Volatility becomes asymmetric, with sharper drawdowns than rallies.

Narratives persist, but market reactions feel less forgiving. Failed breakouts increase. Depth thins during stress. The market becomes sensitive to negative information.

Distribution isn’t visible through headlines. It shows up in how markets respond to pressure.

The Contraction Phase: Risk Is Repriced Aggressively

Contraction begins when liquidity retreats faster than demand can absorb. Prices fall sharply, volatility spikes, and forced selling emerges.

What changes most during contraction is behavior. Risk tolerance collapses. Leverage unwinds. Participants prioritize capital preservation over opportunity. Market makers widen spreads or step back entirely.

Liquidity fragmentation intensifies, correlations rise, execution becomes expensive, and even fundamentally strong assets decline as capital exits broadly.

Contraction feels chaotic, yet it serves a structural purpose. It removes excess, resets expectations, and clears the path for the next accumulation phase.

Why Each Phase Feels Different to Participants

Participants experience each phase differently because incentives change. During expansion, risk feels rewarded. However, during contraction, the same behavior gets punished.

Retail traders often treat cycles with emotions, just reacting to price. Institutions experience cycles operationally, adjusting exposure based on liquidity and risk models.

Market makers experience cycles mechanically, managing inventory and hedging constraints.

These differing perspectives explain why consensus rarely forms around cycle transitions. Each group responds to different signals.

Understanding this helps explain why markets often turn before narratives do.

How Liquidity Defines Each Phase

Liquidity acts as the connective tissue between phases. During accumulation, liquidity improves slowly. While during expansion, it deepens.

On the other hand, while on euphoria, it appears abundant but becomes fragile. While during contraction, it disappears.

Stablecoin liquidity, market maker activity, and OTC flows all shift as cycles progress. These shifts determine whether markets absorb shocks or amplify them.

Reading liquidity conditions offers clearer insight into the cycle’s phase than price alone.

The Role of Leverage Across Crypto Market Cycles

Leverage magnifies cycles. During expansion, leverage fuels momentum and during euphoria, it creates instability. Moreover, during contraction, it accelerates declines.

What changes between phases is not leverage’s existence, but its sustainability. When leverage aligns with liquidity, markets function. When it exceeds liquidity, markets break.

This dynamic explains why cycle peaks often coincide with leverage extremes rather than valuation metrics.

Why Crypto Market Cycles Feel Faster Than Traditional Ones

Crypto cycles feel faster because markets operate continuously, liquidity fragments across venues, and information spreads instantly. Leverage and derivatives accelerate feedback loops.

However, faster doesn’t mean different. The same structural forces apply. Capital still enters cautiously, expands confidently, overextends, and retreats.

Speed changes expression, not sequence.

One common misconception assumes cycles end when narratives fail. In reality, narratives fail because cycles turn.

Another misconception treats cycles as predictable timelines. Cycles vary in length based on liquidity, macro conditions, and participation.

Perhaps the most damaging misconception equates volatility with opportunity. Volatility without liquidity signals fragility, not strength.

What Crypto Market Cycles Signal About Market Maturity

As crypto markets mature, cycles may become less extreme, but they won’t disappear. Better infrastructure improves resilience, yet speculation remains intrinsic.

Mature markets still cycle. They just express cycles differently. Therefore, understanding this reframes cycles as features, not flaws.

Looking forward, crypto market cycles will likely remain compressed yet persistent. Institutional participation may stabilize some phases, but innovation and speculation will continue driving others.

Regulation, infrastructure, and macro conditions will shape how cycles express, not whether they occur.

Markets will still move through accumulation, expansion, excess, and contraction.

Understanding Cycles Beyond Charts

Crypto market cycles aren’t stories told by price alone. Instead, they represent structural shifts in liquidity, risk tolerance, and participation.

By understanding what actually changes between phases, participants gain clarity. They stop reacting to noise and start interpreting structure.

Seeing crypto market cycles clearly means seeing markets as systems, not sentiment machines.

Frequently Asked Questions:

Crypto market cycles describe recurring phases where liquidity, risk appetite, and participation change over time.

No. The sequence repeats, but duration and intensity vary based on market conditions.

By observing liquidity behavior, leverage conditions, and market reactions to stress rather than price alone.

They appear faster due to continuous trading and leverage, but the underlying structure remains consistent.

No. As long as speculative capital exists, cycles will persist.

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Also read

Similar stories you might like.