Bitdeer dumped its entire BTC stack to double down on data centers and AI infrastructure. Source: TechGaged.

A Bitcoin Miner Just Sold Every Last BTC, and the Money Is Flowing Somewhere Else

In Brief

- • Bitdeer sold its entire Bitcoin treasury, cutting its BTC balance to zero. The company redirected capital toward data centers and AI cloud growth. The move reflects a broader rotation from crypto assets into infrastructure and AI.

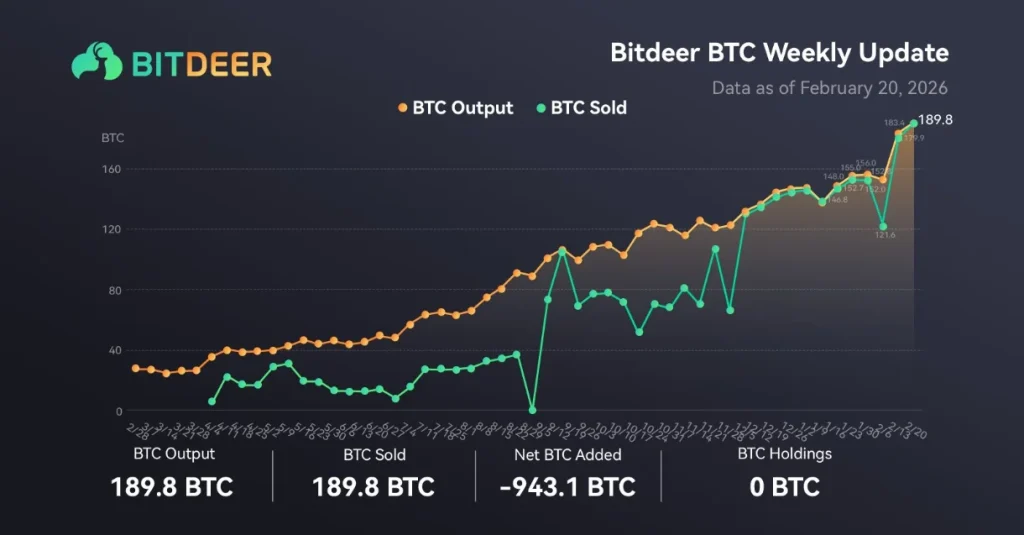

Bitdeer Technologies just made one of the boldest balance-sheet moves in the mining sector. The company sold its entire Bitcoin treasury, including 943.1 BTC from reserves and 189.8 BTC in newly mined coins. As a result, Bitdeer’s Bitcoin balance now sits at zero.

This decision did not come from distress. Instead, it reflects a deliberate capital reallocation. Bitdeer redirected proceeds toward data center expansion, AI cloud infrastructure, and general corporate needs. In other words, the miner chose productive capacity over passive Bitcoin exposure.

That choice stands out. Many miners still treat BTC as a strategic asset or macro hedge. Bitdeer took the opposite path. It converted digital assets into physical and computational infrastructure, signaling a shift in how some miners now think about capital efficiency.

Why Bitdeer Chose Infrastructure Over Holding Bitcoin

Mining economics continue to tighten. Power costs fluctuate. Hardware cycles compress. Competition increases. Therefore, miners must decide where each dollar works hardest.

Bitdeer decided infrastructure delivers more leverage than idle BTC. By funding new data centers, the company can scale hash rate, lock in power agreements, and improve operational resilience. Moreover, expanded facilities support multiple workloads, not just mining.

At the same time, Bitdeer is leaning into AI cloud growth. Demand for compute has surged, driven by model training and inference workloads. Consequently, data centers now serve dual purposes. They support Bitcoin mining when conditions favor it. They also monetize AI demand when margins look better elsewhere.

This approach reduces dependency on Bitcoin price cycles. Instead of waiting for price appreciation, Bitdeer aims to generate returns through utilization and scale. From a corporate finance perspective, that shift prioritizes cash-flow generation over balance-sheet optionality.

Importantly, selling newly mined coins alongside reserves reinforces the signal. Bitdeer is not timing the market. It is reshaping its capital structure.

How This Fits a Bigger Capital Rotation Trend

Bitdeer’s move also aligns with a broader narrative playing out across tech and crypto. As discussed in the analysis on capital rotating from crypto into AI, money did not vanish from innovation markets. It moved toward sectors offering clearer growth trajectories.

That distinction matters. Bitcoin exposure still exists across markets. However, capital increasingly seeks infrastructure, compute, and application layers rather than raw asset holding. AI now absorbs a meaningful share of that flow.

Bitdeer sits at the intersection of both worlds. It understands crypto economics. It also owns the physical layer required to serve AI demand. By selling BTC to fund expansion, the company positions itself where those trends converge.

This does not mean miners will abandon Bitcoin treasuries wholesale. However, it does suggest a playbook shift. When infrastructure outperforms holding, rational capital rotates.

This does not mean miners will abandon Bitcoin treasuries wholesale. However, it does suggest a playbook shift. When infrastructure outperforms holding, rational capital rotates.

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

BlackRock’s Next Crypto Move Could Change Ethereum Investing Forever

2XRP’s Biggest Whales Just Made Their Move, and Supply Control Is Hitting Records

3On-Chain Analysis in 2026: Which Signals Actually Drive Crypto Markets

4The First Regulated Tokenized Equity Trade Is Now Live in the U.S.

5Binance Adds 3,600 Bitcoin to Its SAFU Fund — The Timing Is Hard to Ignore

Latest

Also read

Similar stories you might like.