Large Bitcoin in front of a whale swimming in the back. Source: TechGaged.

Arkham Breaks Down the Largest Bitcoin Holders in 2026

In Brief

- • Arkahm's maps the largest Bitcoin holders across sovereigns, corporates, ETFs and exchanges.

- • ETF custodians and public company treasuries now represent significant BTC ownership segments.

- • Ownership concentration influences effective supply, liquidity dynamics, and long-term structure.

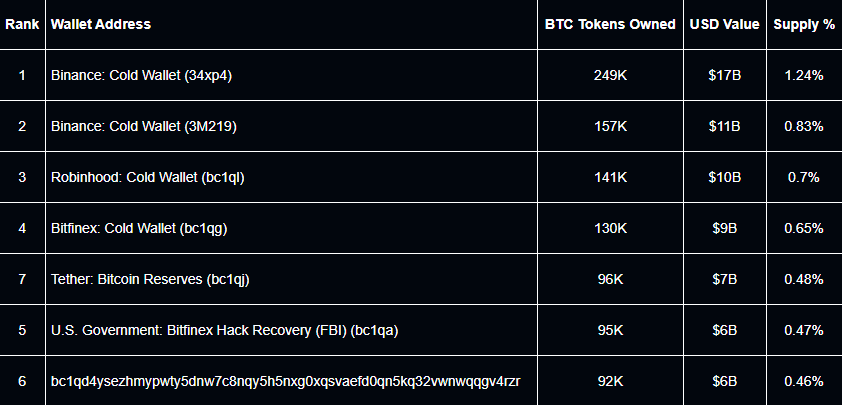

Arkham released a new research guide outlining who holds the largest known Bitcoin balances in 2026. Mapping out sovereign entities, public companies, ETFs, exchanges, and early adopters that control significant portions of BTC’s circulating supply.

The report compiles on-chain intelligence and publicly disclosed treasury data to provide a structured view of concentration across the Bitcoin ecosystem.

Importantly, As institutional adoption accelerates, understanding who holds the largest BTC positions is central to evaluating market structure and long-term supply dynamics.

Sovereigns, Public Companies, ETFs and Exchanges Dominate BTC holdings

First, governments remain among the most significant holders, largely due to law enforcement seizures and strategic reserves.

Indeed, these holdings are typically visible through publicly attributed wallets and official disclosures. Sovereign balances can materially impact supply expectations when liquidation events occur.

Next, public companies represent another major category. Corporate treasury strategies centered on Bitcoin have continued into 2026, with firms holding substantial BTC allocations as part of balance sheet strategies.

Additionally, these positions come through financial filings. Allowing on-chain data to be cross-referenced with public reporting.

Similarly, centralized exchanges collectively control large volumes of Bitcoin on behalf of users. While these balances do not represent ownership, exchange-held BTC remains one of the largest categories on-chain.

Finally, early Bitcoin wallets, including long-dormant addresses and known large individual holders, continue to represent a significant portion of total supply.

However, some of these wallets have remained inactive for years, shaping circulating liquidity assumptions.

Bitcoin Ownership Concentration Matters in 2026

Ownership concentration affects liquidity, volatility, and systemic risk assessment. When a large portion of BTC is held by long-term players, circulating supply can be lower than supply figures suggest.

Furthermore, institutional and sovereign participation has shifted the narrative from retail-driven cycles to capital allocation at scale.

In particular, ETF structures have formalized Bitcoin exposure within traditional financial markets, linking BTC demand more directly to regulated inflows.

Similarly, exchange custody concentration highlights the importance of transparency and proof-of-reserve practices.

While blockchain visibility provides insight, ultimate beneficial ownership can still sit behind custodial structures.

The report frames Bitcoin’s 2026 ownership landscape as more institutional, more traceable, and more interconnected with traditional finance than in previous cycles.

Therefore, monitoring the largest holders becomes more relevant to understanding supply stability and market structure in 2026.

Bitcoin Price Today

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

Bullish Momentum Builds for Altcoins, Signaling Major Reversal

2Bitcoin Bear Cycle Warning – Here’s What It Means

3R. Kiyosaki Warns of Giant Market Crash, Calls Panic Selling an Opportunity

4XRP Network Activity Drops 26% in a Week – Trouble Mounting?

5FCAT Expands Cross-Chain Security on LayerZero

Latest

Also read

Similar stories you might like.