Bitcoin logo screen. Source: TechGaged / Shutterstock

BTC Stress Signal Flashing Again; Here’s What It Says

In Brief

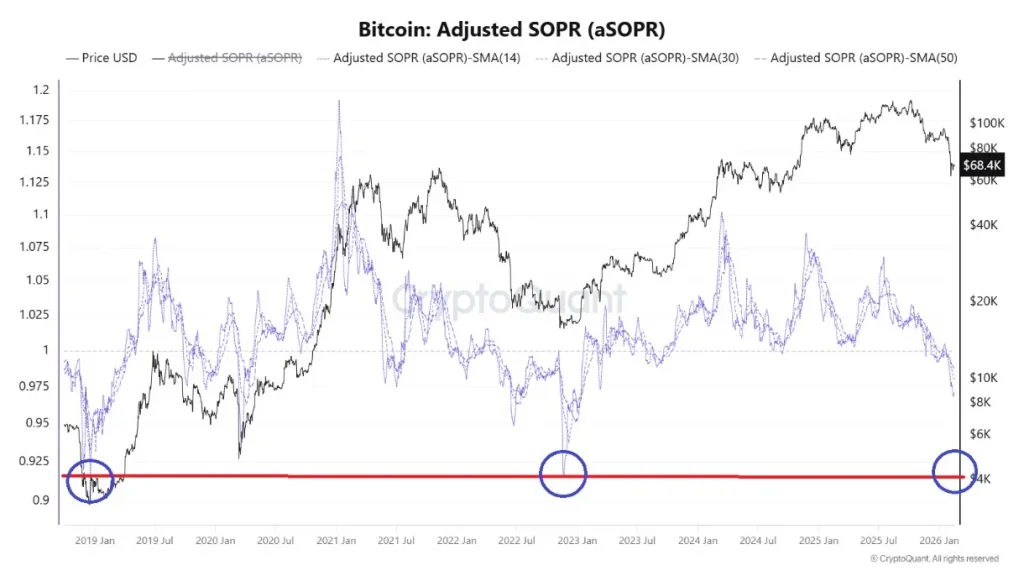

- • Bitcoin aSOPR dropped to ~0.92–0.94, a historic stress zone.

- • Past readings aligned with deep corrections or bear phases.

- • Key signal: reclaim 1.0 or risk broader downturn.

Bitcoin (BTC)’s adjusted SOPR has fallen back into the 0.92-0.94 zone, a level historically linked to bear market stress. Analysts note that similar readings appeared during deep corrective phases in 2019 and 2023. The signal suggests BTC may be transitioning from a correction into a broader structural downturn.

What The Data Shows

The Adjusted Spend Output Profit Ratio (aSOPR) measures whether coins are being spent at a profit or loss.

The key takeaways from the current Bitcoin reading, shared by CryptoQuant’s analyst Woo Minkyu on February 16, include aSOPR below 1.0 (coins moving at a loss), multiple cycle lows historically forming near 0.92-0-93, and the current reading equal to a return to prior capitulation zones.

In both 2019 and 2023, dips into this range aligned with heavy loss realization and macro bottoms forming later. Unlike short-term corrections where aSOPR quickly rebounds above 1.0, this move shows prolonged compression, which is a sign of weakening market structure.

Why This Matters For Crypto Traders

aSOPR is widely used to identify market regimes, including a bullish profit-taking environment at above 1.0, neutral consolidation near 1.0, and loss realization and stress at below 1.0

If BTC fails to reclaim 1.0 soon, analysts warn that the probability rises that the market is entering a deeper bear phase rather than a simple pullback. Historically, durable bottoms tend to form only after extended SOPR compression, capitulation spikes, and seller exhaustion.

Current readings suggest stress is building, but may not yet represent full capitulation.

Bitcoin is now trading at a price of $68,852.57, indicating a 1.2% drop on the day, an increase of 0.4% over the week, and a 27.1% dip across the past month, per the latest chart data.

What Happens Next

In a bearish scenario, aSOPR remains below 1.0, loss realization continues, and there is prolonged consolidation or macro downtrend. In a bullish case, Bitcoin rapidly reclaims 1.0, makes a reset similar to mid-cycle dips, and recovers faster in sentiment.

Analysts emphasize that timing matters, as previous bear transitions unfolded over months, not weeks.

Bottom Line

Bitcoin’s aSOPR has entered a historically dangerous zone. Though not yet signaling final capitulation, the metric suggests structural deterioration beneath the surface. For traders, the key signal now is whether SOPR can reclaim profitability, or if this marks the early stages of a broader bear regime.

BTC Price Today

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Also read

Similar stories you might like.