Hooded person portrait. Source: TechGaged / Shutterstock

Crypto-Linked Human Trafficking Cases Up 85% YoY, New Data Shows

In Brief

- • Crypto flows to suspected trafficking networks rose 85% in 2025.

- • Stablecoins are widely used in large illicit payments.

- • Blockchain transparency is aiding investigations.

Cryptocurrency flows to suspected human trafficking services surged 85% year-over-year in 2025, reaching hundreds of millions of dollars, according to new data. Nearly half of transactions tied to Telegram-based ‘international escort’ services exceeded $10,000. The spike highlights the growing professionalization of these networks and how blockchain transparency is becoming a critical investigative tool.

The 2025 Surge: What Changed?

In its report published on February 12, Chainalysis tracked four major categories of suspected crypto-facilitated trafficking activity, including Telegram-based ‘international escort’ services, ‘labor placement’ agents tied to scam compounds, prostitution networks, and child sexual abuse material (CSAM) vendors.

The growth aligns with the expansion of Southeast Asia-based scam compounds, online gambling operations, and Chinese-language money laundering networks (CMLNs), many operating via Telegram.

Unlike cash, blockchain transactions leave permanent trails. That visibility is increasingly being used by investigators to map flows, identify chokepoints, and disrupt operations.

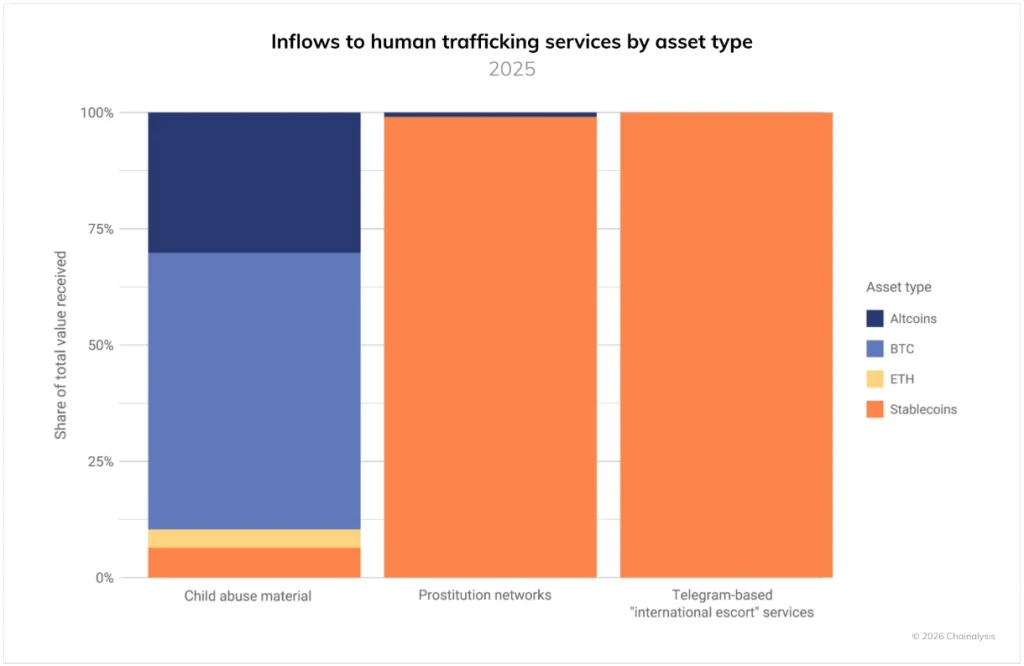

Stablecoins Dominate Escort and Prostitution Networks

Payment behavior differs sharply across categories.

Telegram-based ‘international escort’ services and prostitution networks rely heavily on stablecoins. CSAM vendors historically preferred Bitcoin (BTC), though alternative Layer 1 networks are rising. Monero is increasingly used for laundering in CSAM-linked operations.

The heavy use of stablecoins suggests these networks prioritize price stability and rapid off-ramping, even with the risk of asset freezes by centralized issuers.

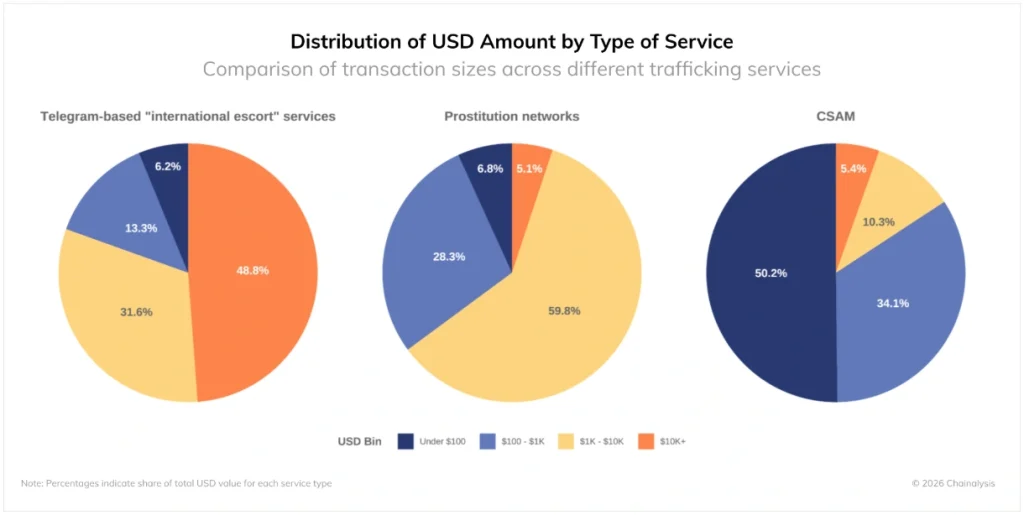

Nearly Half of Escort Transactions Exceed $10,000

Transaction size data reveals how structured these operations have become. Nearly 50% of Telegram-based escort transactions exceed $10,000, prostitution networks cluster in the $1,000-$10,000 range, and CSAM transactions skew lower, with many under $100.

Large transfers suggest organized, scaled criminal enterprises rather than isolated actors.

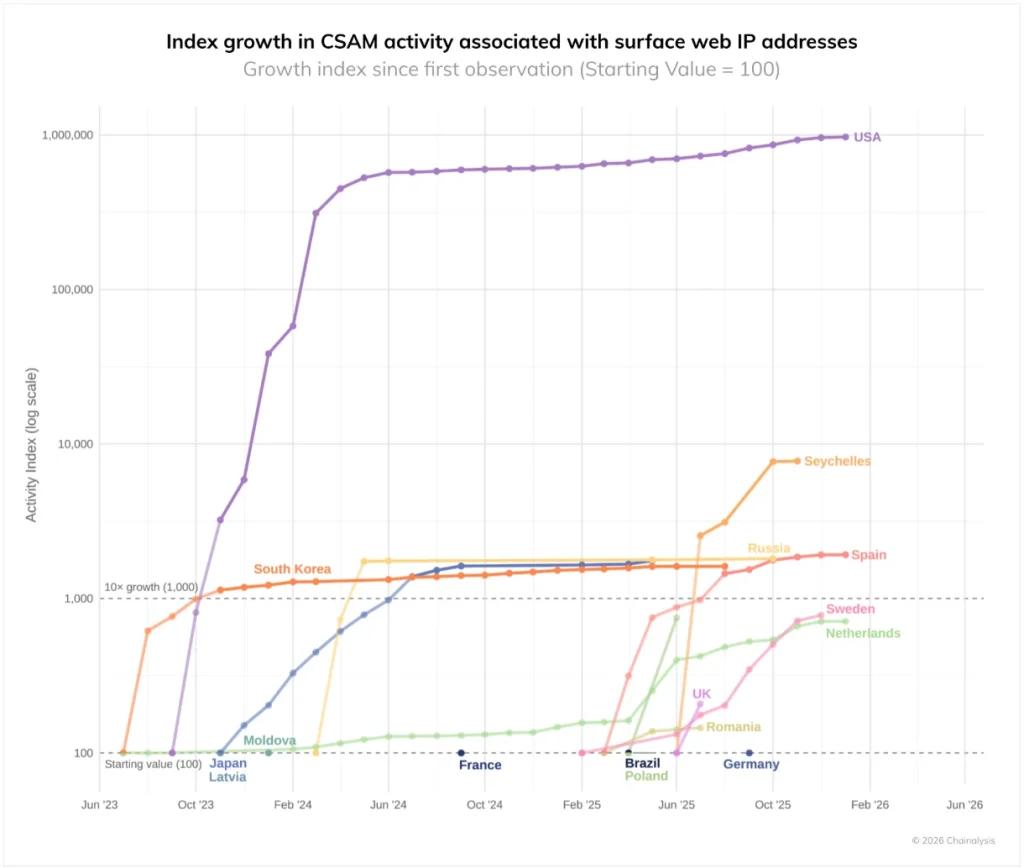

CSAM Networks Shift to Subscription Models

CSAM-related activity continues evolving. Subscription-based revenue models dominate, payments are typically under $100/month, there is increased overlap with sadistic online extremism (SOE) communities, and a greater use of instant exchangers and privacy tools.

In one 2025 case, a darkweb CSAM site used over 5,800 crypto addresses and generated more than $530,000 since 2022, exceeding revenue tied to the 2019 ‘Welcome to Video’ case.

Geographic analysis shows strategic use of U.S.-based infrastructure, likely for scale and perceived legitimacy.

Deep Integration With Chinese-Language Money Laundering Networks

Telegram-based escort services show strong financial integration with CLMNs, guarantee platforms, and mainstream exchanges.

Funds often pass through institutional-grade platforms before conversion into local currency. This creates both scale and vulnerability as exchanges and guarantee services become compliance chokepoints.

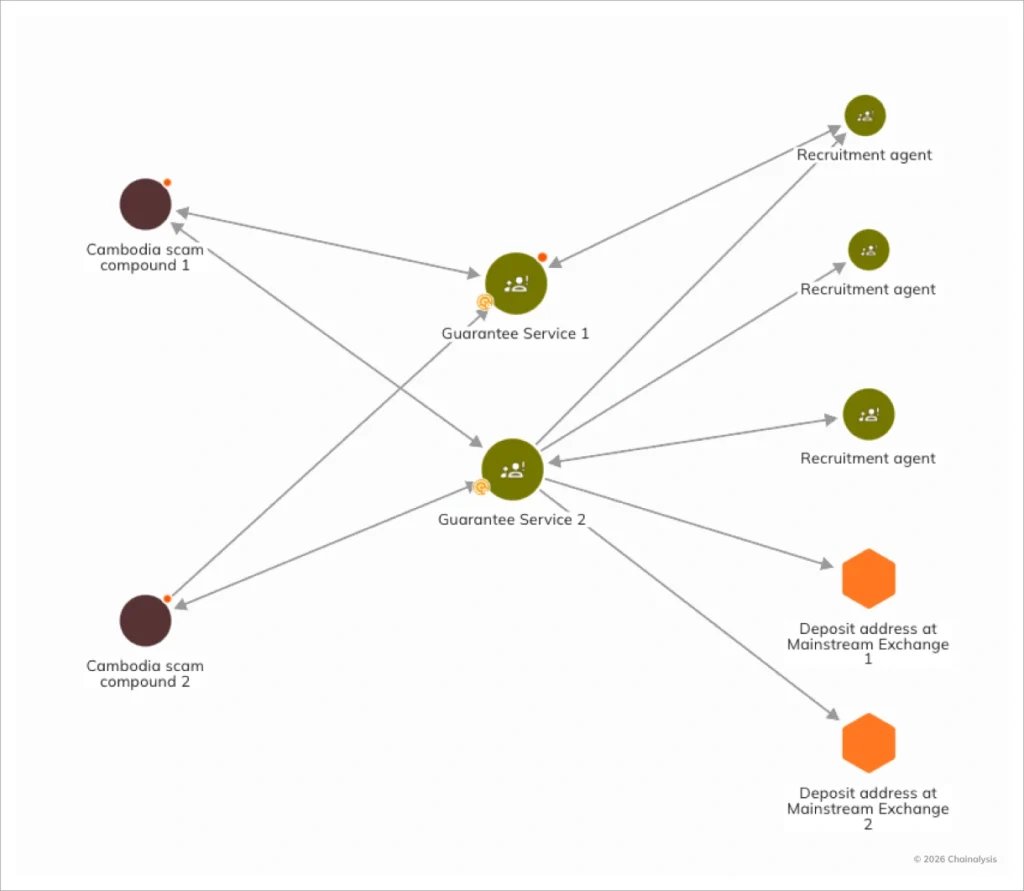

‘Labor Placement’ Agents and Scam Compounds

Human trafficking linked to scam compounds remains tightly connected to crypto. Victims are recruited via fake job ads, then coerced into scam operations in Southeast Asia.

Recruitment payments typically range from $1,000 to $10,000, matching observed on-chain transaction patterns. Blockchain analysis has also tied certain admin accounts to criminal organizations previously flagged by UNODC.

Global Reach of Southeast Asian Networks

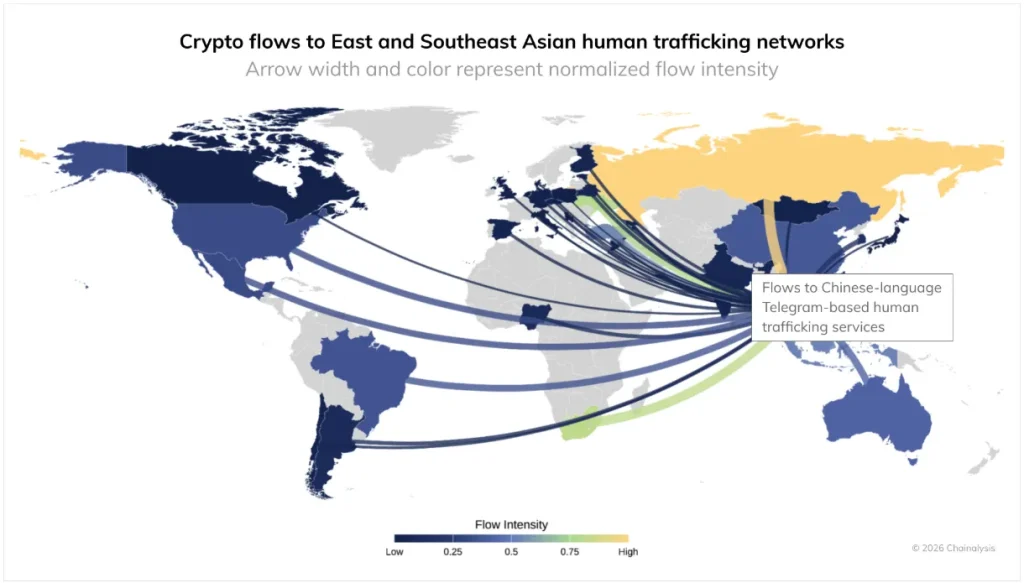

Chainalysis data shows major crypto inflows from the United States, Brazil, the United Kingdom, Spain, and Australia. Chinese-language Telegram services operating across mainland China, Hong Kong, Taiwan, and Southeast Asia demonstrate global payment infrastructure.

Crypto enables cross-border payment coordination at scale, but it also exposes flow patterns that investigators can analyze.

Key Risk Indicators Compliance Teams Monitor

Chainalysis has highlighted several red flags. These include large recurring payments to labor agents, high-volume flows through guarantee platforms, stablecoin conversion clusters, cross-border transaction concentration, and wallet overlap across multiple illicit categories.

Though the scale of activity is alarming, blockchain transparency provides measurable, traceable data that law enforcement can leverage, unlike traditional cash-based systems.

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

Bitcoin Would Need to Reach $1.7M per BTC to Match Gold’s Market Cap

2White House Urges Stablecoin Deal, Sets the Deadline as Debate Continues

3BlackRock’s Tokenized Fund Just Found a New Trading Environment

4Binance Opens RLUSD Deposits, Expanding Ripple’s Institutional Push

5Coinbase Introduces a Wallet Built for Machines, Not Humans

Latest

Also read

Similar stories you might like.